At any age, everyone is careful about money. Therefore, people put more importance on payment terminals, the tools of processing financial payments. How to prove that the payment processing is secure enough? Passing certifications is necessary.

As digitalization deepens, more financial crimes appear and bring great loss to consumers. Many governments and organizations formulate laws, regulations and technical standards to supervise financial payment terminals. These specifications protect payment accounts and data from potential attacks. In this context, obtaining financial payment certifications is extremely important for POS terminals.

Compliance. As more regulations are formulated to guarantee payment security, POS terminals have to pass a series of security tests. The payment terminals without regulation compliance even lost the ticket to enter the fierce international competition. To win a broader market, POS terminal providers must make their terminals compliant with more regulations of financial payments.

Security. Before obtaining certifications, POS terminals have to achieve a high standard of payment security in the financial payment industry and pass the required examinations. The certifications are evidence that the terminal providers have grasped the leading technology and the terminals are reliable enough to protect users’ payment from attacks.

Trust enhancing. Every customer hopes to be sure that their information and data can be kept properly. The POS terminals that are able to protect customer data and reduce payment risks can win the trust of customers. POS terminals with multiple security certifications can provide more trust and enhance customers’ payment confidence in the digital age.

Main international certifications of financial payment

To fight against the new threats to the financial system, governments of financial organizations around the world set a variety of laws, regulations, technical standards and requirements. The main well-known international certifications of financial payment include PCI, EMV, PayPass, PayWave, etc. Read on and you will know more.

PCI PTS. The full name of PCI PTS is Payment Card Industry PIN Transaction Security, which is a standard applicable to all payment security terminals that process and transmit cardholder data or sensitive data. PCI SSC, whose full name is Payment Card Industry Security Standards Council, is an authoritative standard organization in the field of international bank card payment security. PCI PTS ensures the security of cardholder data and sensitive data mainly from the physical and logical perspective.

EMV. EMV Standard is an IC card standard issued by the IC card standard organization, EMV Co. It is divided into two parts, respectively EMV Contact and EMV Contactless. In terms of data structure, each part is divided into 2 levels. Level 1 is the level of basic communication level and Level 2 is the application logic level.

PayPass. PayPass is a non-contact payment technology launched by Master Card in 2003. Without a password or signature, users can complete card payments through the payment-acceptance terminals at the store.

PayWave. PayWave is a feature based on Visa chip cards and applies NFC technology. Visa is the largest bank card organization in the world.

Telpo has been actively practicing the security standards and norms of international organizations, and Telpo EFT-POS, TPS900 and P8 have obtained the certifications above. With the certifications of financial payment, Telpo provides its global cooperative partners with secure payment terminals and solutions.

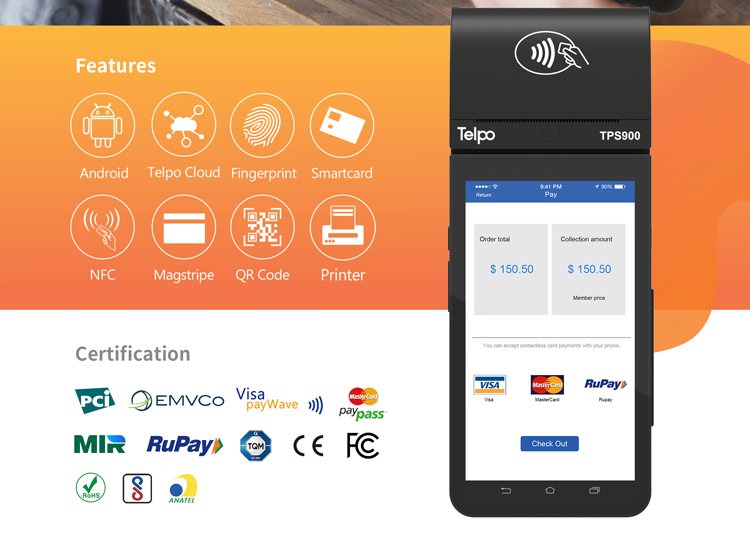

Telpo TPS900 Smart Payment Device

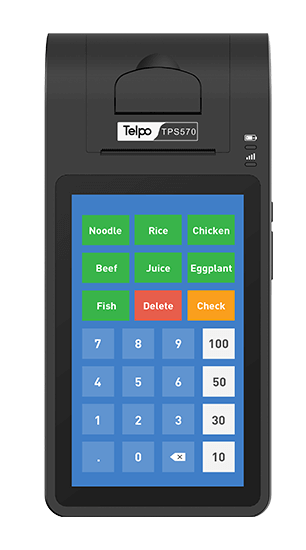

TPS900, smart Payment Terminal

Telpo TPS900 has all high-security certifications, including PCI 6.X, EMV, PayWave, PayPass, MIR, RuPay, PURE, TQM, CE, FCC, RoHS, BIS, Anatel, etc.

√ High-performance. 5.5-inch mobile POS of Android OS and Qualcomm chip.

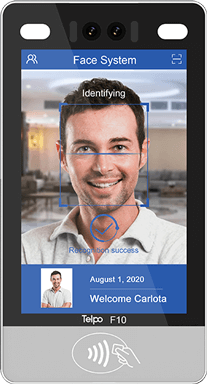

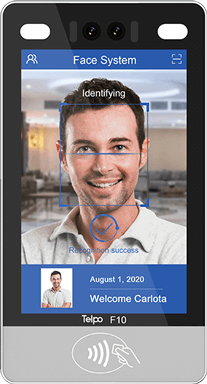

√ Multiple payment options. Credit card chip cards, magnetic cards, NFC cards, QR codes, e-wallets, face recognition payments, etc.

√ Strong expansibility. Can be externally connected to OTG, UHF, TPUI, tax control module, physical keypad, etc.

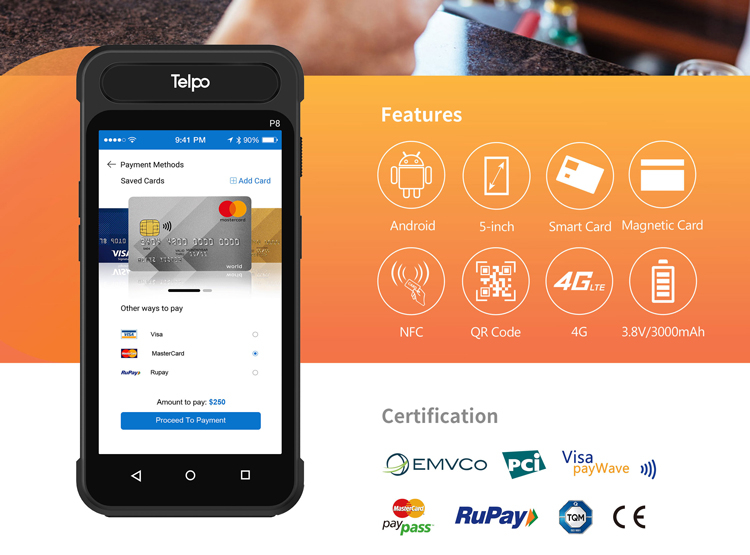

Telpo P8 Mini POS

Telpo P8, mini credit card POS terminal

Telpo P8 is a mini POS with a variety of financial payment certifications. Telpo P8 has passed PCI PTS V6.X, EMV Contact L1&L2, EMV Contactless L1, PayPass, PayWave, RuPay, TQM, CE, etc.

√ Delicate design and high performance. 5-inch screen, Android 10 OS, Quad-core chip.

√ Superior barcode reader. 1D/2D barcode reader ensures high-speed laser decoding.

√ Durable battery. 3.8V/3350mAh battery ensures long working hours.

New softPOS terminal M1

Founded in 1999, Telpo is a smart terminal and solution provider. Telpo products have won recognition from customers from 120+ countries and regions. Welcome to contact us for more details. Telpo has the confidence to boost your business.

Tag: financial certification, payment terminals, POS terminal, payment security, terminal providers

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)