Pandemic has accelerated the shift in consumer spending from cash to cards. As stay-at –home order spread across in many countries since the beginning of pandemic, cash was viewed as a potential means for spreading virus. Many merchants started to encourage using cards and in some cases outright banning cash.

"GO Digital"Payment

According to a survey, more than 40% consumers are using cash less frequently since the outbreak of COVID-19. Particularly those with a household income over $150,000 a year and belong to generation X (38-53 years old), have declined cash utilization of 64 % and 54%, respectively.

And there are some consciously and subconsciously concepts deeply impact consumer payment choice at offline stores. As consumers tend to control less contact, minimize time spent and reduce shopping event, contactless payment seems to be the perfect solution by enabling a more efficient and hygienic payment experience.

Besides, the survey has revealed two key contactless trends, one is new user activation and another is the increased utilization. Importantly, 86% of first-time contactless users plan to continue making contactless payments. That means the process of cash displacement will be accelerated and contactless payment will undoubtedly gain more and more poplar in the future.

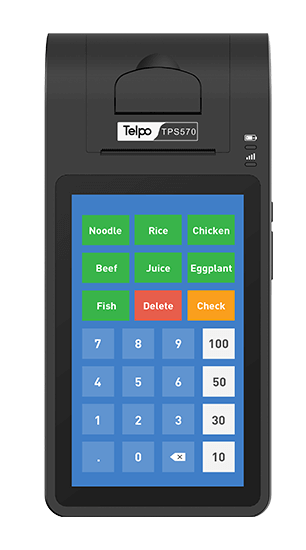

In the context of cashless payment, the smart payment terminal that embraces card payment and mobile payment methods seems more and more importance. As a leading smart terminal & solution partner, Telpo developed a series of smart payment terminals for selection.

EFT-POS TPS900

l 5.5-inch industrial screen+ Android version+ Qualcomm chip enable high-duty development

l Multi-payment methods: face pay, QR pay and NFC, IC and magnetic stripe card payment.

l Rich financial certification: EMV L1&L2, PCI, EMV Contactless L1, Paywave, Paypass, MIR, Rupay, TQM, CE, FCC, RoHS, BIS, Anatel further ensure payment security.

l Tax control, fingerprint and digital keypad is available

Mini POS TPS328

l Telpo OS+ physical keyboard

l Financial equipment( inbuilt NFC/RF card, Magstripe, and IC card reader)

l Communication:BT /USB

l Full financial certification(EMV, PCI, Paywave, Paypass, etc)

Mobile POS TPS320

l 5-inch+ Android 7+ Qualcomm Quad-core processor

l 2SIM+2PSAM (up to 4SIM card), allowing multi-operation cards.

l Support NFC payment, QR code payment, customer can order at store or order at phone in advance

l Web page, label and ECS\POS printing is available

Tag: contactless payment, pandemic, cash, smart payment terminal, EFT-POS, Mini POS, Mobile POS

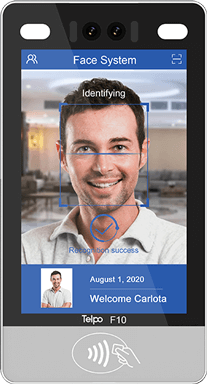

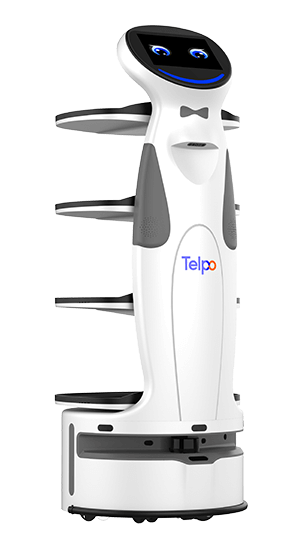

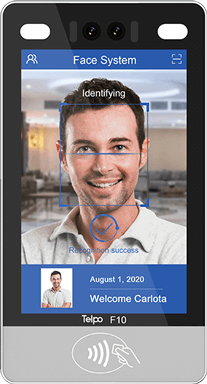

Brief Introduction: Telpo is a professional smart payment partner who focuses on the ODM service for 20 years. It mainly provides the EFT-POS, cash registers, biometric devices, facial recognition machines, self-service kiosks, and bus validators. Telpo has served more than 1000 customers abroad, including government, banks, Telecom operators, police stations, Retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)