Nowadays, EDC machine is a common machine in payment places. Living in an economic globalization and Internet era, it is a common thing that every legible and qualified citizen owns at least one bank card, no matter debit or credit card. Even though mobile payment is increasingly popular, your payment account still requires linking to your bank card for deducting.

What is edc machine?

The edc (electronic data capture) machine is also called a credit card swipe machine or an edc card machine. It refers to the payment terminal that assists customers to complete the transaction through swiping or dipping cards and ensure merchants successfully receive payment.Once a card is swiped/dipped, the edc machine will capture the essential information (card name, card number, transaction amount, etc) link to the card and transfer them to the card issuer for authentication via SMS, email, telephone, or wireless internet. It will also record the transaction place, date, and time for follow-up checking. It is conducive to guaranteeing rights and interests and facilitating the transaction for both customers and merchants.

What is the difference between edc machine and dcc machine?

People from all around the world might come to other countries for travel, business, education, etc, making credit card settlement more crucial in such a process. When it comes to cross-border settlement, then it will expand to another concept, the dynamic currency conversion (DCC) machine. Then, what is the difference between edc machine and dcc machine?DCC refers to the dynamic exchange rate conversion service, which allows the cardholder to complete the transaction in the foreign country with his home currency. It allows the cardholder to know the real-time exchange rate during the payment process and makes them easier to reconcile purchases when paying card balances. And it is the great difference between dcc and edc. Cardholders won't know the home currency amount but only the local currency price where they locate until they get the billing if they choose edc method.

To sum up, dcc machine is the credit card machine that supports dynamic exchange rate conversion and will show the cardholder the real-time transaction amount and exchange rate in his chosen currency. And edc machine will directly use local currency to complete the transaction.

What is the benefit of edc machine?

Against the backdrop of mobile payment and digital currency prevail, the edc machine still takes the dominant role in the payment industry. What is the benefit of the edc machine and make it so significant and irreplaceable?Convenience: The popularity of credit cards makes consumers have 2-3 credit cards per capita, and the edc machine allows them to swipe every bank card they hope for any time and anywhere for payment. Compared with the small transfer amount limited by mobile payment, the edc machine can provide a larger transfer amount on that basis.

Security: The edc machine is usually provided or certified by the bank, and the latter has a strictly digital authentication and identity verification security system to ensure safe and reliable fund settlement. In addition, it can reduce the bank counter transaction cost, lower the risk of cash theft and receiving fake money.

Satisfy customer demand: For cardholders, edc machine is the crucial payment terminal that cannot be replaced. They can gain points or access to more benefits when they pay by credit card, which will also give them a hand to cope with financial difficulties when they are strapped for cash. Moreover, it is constantly evolving to cater to more customers’ payment habits. Today, edc machine not only supports credit bank payment but also NFC payment, QR code payment, or biometric-based payment.

Financial management: In virtue of electronic data capture and one-click print transaction flow function, the edc machine makes daily sales be seen at a glance, and streamlines the work of manually recording and analyzing sales data to some extent.

Boost revenue: According to statistics, credit card consumption can easily boost merchants' 40% of sales. That means installing an edc machine at the store can stimulate consumer spending power as they are more willing to shop at the store that supports Unionpay. That’s because credit card has a one-month interest-free period and there will be no interest if customers can pay back the money to the bank before the repayment date.

Environmental protection: The edc machine, to a large extent, can reduce the risk of cash management of enterprises and merchants, and shorten the workload of manual cash collection, counting, change, and cash storage. Most importantly, it is relatively more sanitary and environmentally friendly than cash transactions.

How does edc machine work?

As we already know that the edc machines are used for accepting payments at all places that require payment. Customer can choose their preferred payment method to complete the transaction, including Debit Card, Credit Card, QR codes, UPI, PPB, and Net Banking.Then, how does edc machine work and how to use it? First, you should provide your credit card to the staff who will put it in the edc machine and pass it through a narrow slit. And then, the edc machine will extract and show the vital information that is etched on the credit card, namely, cardholder name, credit card number, and the expiry date of the credit card. And it will also record the location of the store where the transaction is done.

The obtained information will be processed within seconds and then transport to the merchant service provider via wired or wireless internet. Once the data gets authorized, the amount will then be transferred to the merchant.

How to choose an appropriate edc machine?

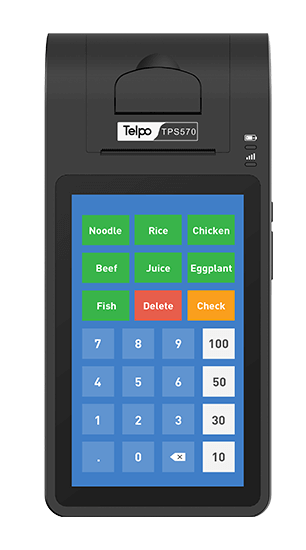

There is beyond doubt that if you want to provide card payment service at your store, high quality and appropriate edc card machine is a necessity. As a 22-year smart terminal&solution provider, we will use our experience to show you what factors you should take into consideration. Let’s take the hot sale edc machine TPS900 as an example.

1. Configuration

The operating system, processor, and memory play a great role in ensuring the smooth and stable operation of the machine. Of course, Android may be a good option if you want to do secondary development. With an industrial leading Android 10 system and 2+16 big storage, the device access to faster and easy-to-use operation and easy secondary development. We will configure the most suitable EDC machine according to the customer's needs.

2. Design:

There are different types of edc machines in the market nowadays, and you should choose the one that conforms to your actual demand. Besides, the interface design and grip feeling should consider as they might affect the working efficiency of the staff. Too weight or hard to use will cause a bit of problem.

3. Financial certificate

As a transaction terminal, the financial certificate is significant. The edc machine device you’re planning to support should at least own the financial certificate that your country requires. As a global payment partner, Telpo TPS900 has PCI 6.0 certificate, EMV, PCI, Paywave, Paypass, MIR, Rupay, TQM, CE, FCC, RoHS, BIS, Anatel, etc, in a response to satisfy different partners certificate requirements and ensure payment security.

4. Payment method

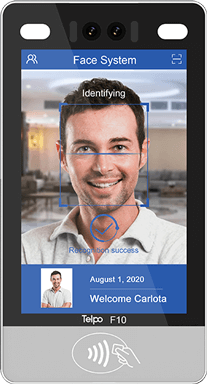

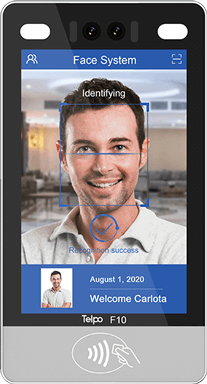

As we all know that everyone’s payment habit is vary and it is hard to judge which one is more popular. Thus the more payment methods you could provide to your customer, the more surprise you might obtain from them. And edc machine Telpo TPS900 can provide face payment, fingerprint payment, QR Code payment, and NFC/ IC payment, which complies with the payment regulation and help to enhance customer payment experience.

5. Communication

No matter where your store is located, it is hard to operate the edc device or send the data to the platform without a network, particularly credit card payments require bank authentication. Rich communication includes LTE/WCDMA/GPRS/WiFi/Bluetooth will provide you more freedom to establish edc machine system and private network.

6. Print

It is normal and legal for customers to ask for receipt printing no matter what is the purpose. Thus, you should choose the edc card machine that supports printing and is also easy to change the printing paper.

7. Battery life

To ensure a long time working, big enough battery, standby battery or convenient charging is of importance. Otherwise, both staff and customers will be embarrassed if the edc machine suddenly has no power and fail to work.

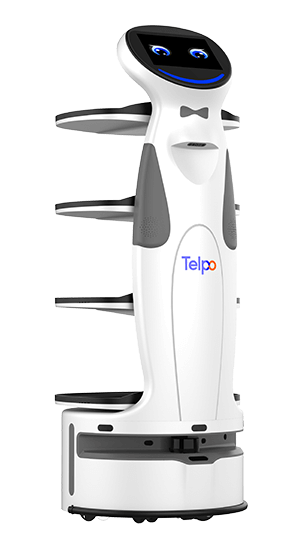

8. Additional value

Generally speaking, the current edc card machine not only can support payment, but it can also enable member management, marketing management, platform remote management, or even customized services you require. For Telpo devices, Telpo MDM and APP Store are also available. The App Store allows you freely download the software you require and the Telpo MDM allows you to remote monitor store operation, data cloud store, multi-device cloud management, and other customization services.

9. Brand

As we all know, a company brand has a decisive impact on R&D capability, team strengthening, and after-sales service, not to mention the product quality. The more financial projects the company does or cooperates with the head customer in the financial industry, the stronger brand impact and ability can be trusted.

How can edc machine guarantee payment security?

When it comes to transactions, security should be put in the first place anytime and anywhere. Then you might be curious that how can edc machine guarantee payment security? The following part will give you’re the answer.1. Identity verification

The user identity of the edc machine will be checked and verified once it is connected to the server. Only the authenticated edc card machine will be assigned an IP address. Once the bank POS host receives the transaction data, it will compare the merchant number and edc card machine series number with the database to ensure the device access legitimacy.

2. Data security

Both the transaction data packet and transactions encrypted method are in line with the ISO8583 model. That means the data encryption protection and MAC in the application layer will jointly effort to ensure the edc machine system transaction data security. The sensitive data include accounts and passwords will also be protected with the international standard encryption algorithm 3DES.

3. EDC machine security

As edc card machine will contain a GPRS SIM card, which can access a certain system to avoid illegal intrusion. The machine master key is encrypted and stored with a special secure CPU to ensure the security of the master key.

4. Internet security

The CS-1 and CS-2 feature the transmitted data encryption protection, thus it can prove the security of the GPRS transmission coding. In addition, an internal virtual private network will be built via VPN or SDH technology to make sure edc card machine can securely access the POS host and internal network resources of the bank, to ensure the reliability and security of the wireless network of the edc card machine system.

5. Firewall

A firewall is a significant channel to protect network security, which can greatly improve the security of the internal network, prevent attacks from untrusted networks and reduce risks by filtering insecure services.

6. PCI Certificate

The officially financial edc machine had to pass the Payment Card Industry certification (PCI) to ensure the security of credit card data. It represents the world's most rigorous and the highest level of financial machinery safety certification standards.

7. Electronic Signature

An electronic signature can elevate payment security and make payment more environmentally and friendly. After completing the transaction, the electronic signature will be uploaded to the system. Customers can print the receipt if they want, which will contain the cardholder's electronic signature with digital anti-counterfeiting and able to prevent being stolen or tampered with and then increase payment security.

8. Contactless Payment

Nowadays, according to the new regulation of UnionPay, the financial terminal should support a contactless payment function to allow customers to tap and pay in response to streamline the transaction steps and increase payment security.

How to prolong edc machine service life?

1. Do not use the edc machine in a very low or high-temperature environment or put it in a damp place, the operating environment will also affect the machine's internal key and performance and even cause data damage.2. Do not shake or strike the device. Because the general machine owns an anti-disassembly function and it will easily lose the password or data when you flap it.

3. Do not press the switch button of the machine to continue to keep its normal operation.

4. Keep the edc machine clean and not place other items above it to avoid compression failure and not clean it directly with liquid or spray.

5. Do not remove the machine shell without authorization. There is a protection mechanism inside the machine. Once removed, the machine will be under attack and cannot be used.

6. Do not use or replace batteries in a flammable and explosive environment. If you require changing the removable battery, please make sure that the metal contact does not touch any other metal objects. If power loss happens, you should immediately replace the battery to prevent further accidents.

7. When charging the edc card machine, please insert the socket firmly, and control the charging time within 5 hours. The green light indicates the full charge of the machine.

8. You should charge the machine when the power is insufficient during the transaction process. Otherwise, it will lead to the failure of card swiping or receipt printing.

9. If the machine prints the empty receipt, it is better to change the paper direction or change another paper roll.

10. Please put the machine on a fixed and stable table. If you require to carry it at hand, please make sure tightly hold it. Otherwise, the drop will damage the device.

Tag: Edc machine, edc card machine

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)