In addition to guaranteeing the revenues of government from taxes, business data are an important economic indicator reflecting consumer trends and economic health. As digitization increased, it has been much easier for businesses to manipulate business data secretly, which has added to tax authorities’ difficulty. How to record business data accurately and efficiently? A fiscal cash register is needed.

A fiscal cash register is equipped with a tax storage, which keeps recording daily business data and tax payable. The data that the tax storage records can’t be changed or erased. Don’t attempt to remove the tax storage from the cash register. It is impossible. The tax storage is fixed inside the fiscal cash register with special sealing means, which makes it not be opened by people except tax authorities and registered maintainers. So a fiscal cashier machine ensure tax authorities grasp business data and tax documents accurately.

What benefits can be brought by the widespread use of fiscal cash registers?

Better tax compliance.

The fiscal cash registers record every transaction as well as generate and save sales data automatically. What’ more, no one is able to tamper with the business data. Grasping accurate business data is a great help to government tax revenues. It is more difficult for businesses to cheat on their taxes for their business data will be sent to tax authorities remaining unchanged. Tax authorities can trace every transaction, making sure businesses pay enough taxes in accordance with law. And therefore, the government’s revenue is guaranteed.

Protection of fair competition.

It is a great challenge for businesses to pay taxes conscientiously and honestly. With the development of technology, it is much easier for businesses to change their sales data to evade taxes. If more and more businesses use technology to tamper data, it will become more unfair to the honest businesses. In the case of earning benefits, businesses that evade taxes spend less and earn more than businesses that pay taxes honestly. As time passes, less businesses will pay the taxes honestly. Widespread use of fiscal cash registers can efficiently avoid tax cheating, improving competitive environment. When it gets harder and harder to evade taxes, businesses will pay more attention to improving the quality of goods and services to earn more benefits.

Greater efficiency of government

Since the fiscal cash registers record every transaction, business data that tax authorities need are available. Without fiscal cash registers, tax authorities have to conduct field audits in order to determine reliability of data, which requires much time, money and human efforts. However, common use of fiscal cash registers can help solve this problem. The tax storage inside providing absolutely reliable information saves the time for distinguishing the business data. What’s more, it ensures data security and the government can be free from the burdens of recording, saving and reporting, improving the efficiency of tax authorities.

Consumer protection

Recording and saving transaction data not only helps government improve efficiency, but also protect consumers. If consumers lose their trading certificates, businesses have excuses for offering after-sales services or returning. If every transaction is recorded, in spite of losing receipts or other trading certificates, consumers’ rights and interests can be protected. It guarantees consumers to return the goods when they are not satisfactory with their purchases. Accurate recording protects the consumers and create a good environment for consumption.

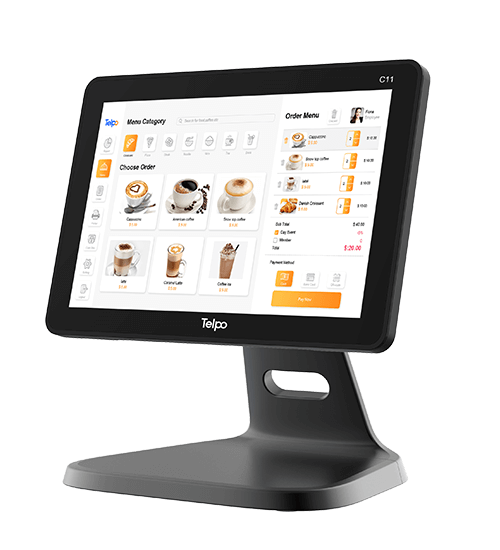

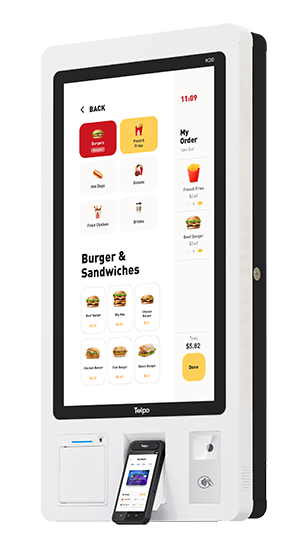

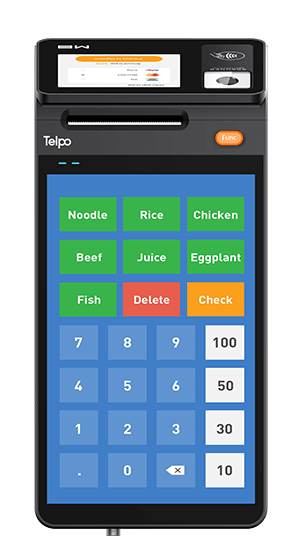

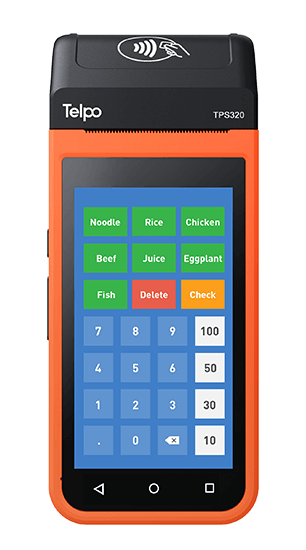

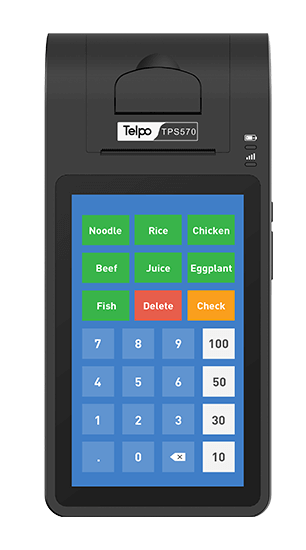

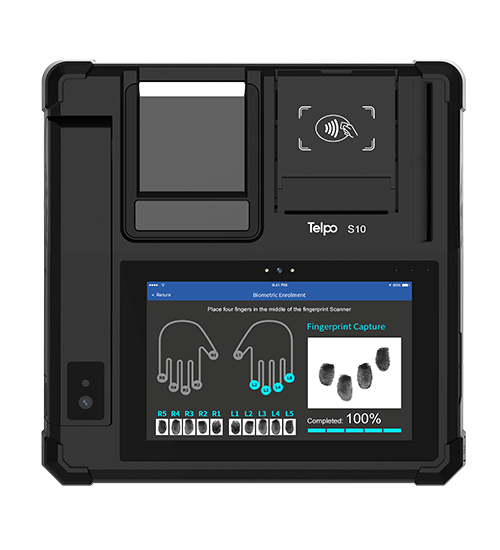

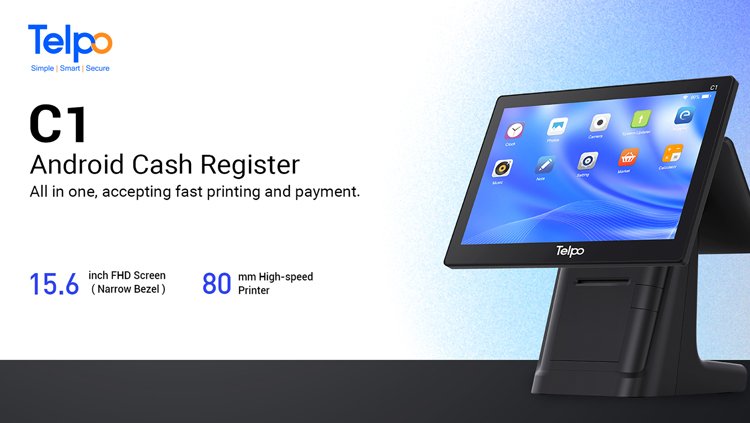

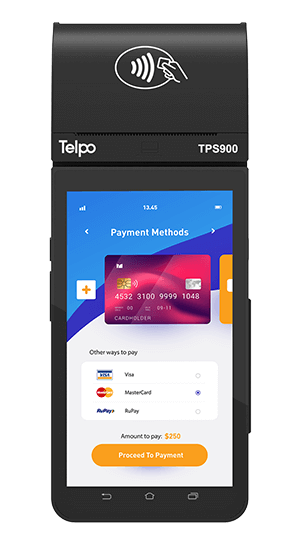

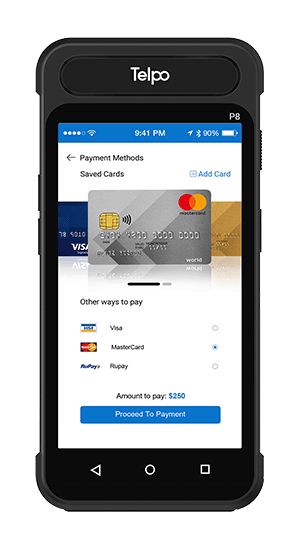

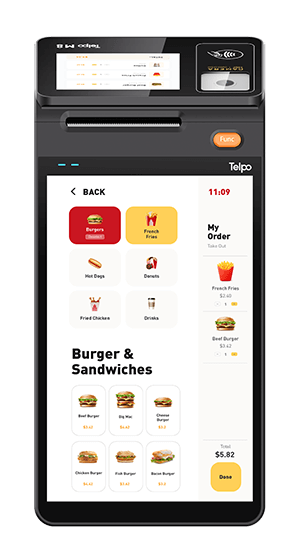

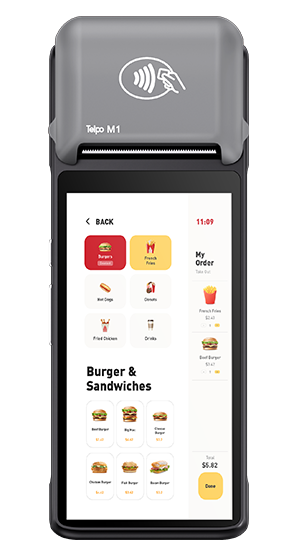

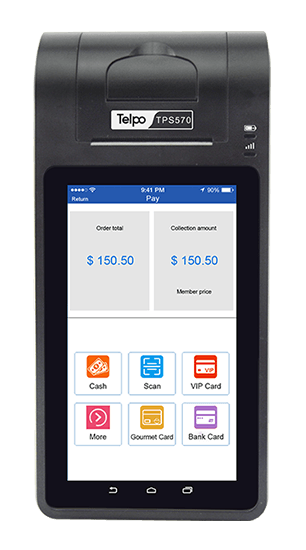

Smart cash registers launched by Telpo support the built-in tax control module. If you need a fiscal cash register, Telpo C1 and TPS680 can satisfy your needs.

Multiple application scenarios

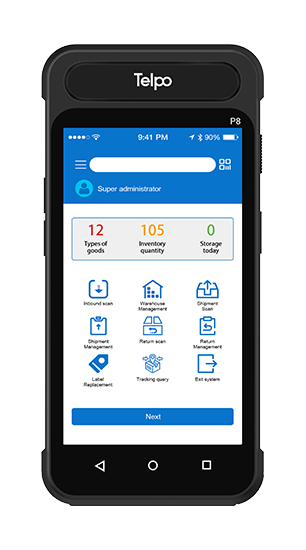

Smart cash registers can be applied in lots of scenarios, such as supermarkets, convenience stores, retail shops and so on. Modern and fashionable design of cash registers upgrade the decoration of the stores.

Increasing chances of attracting customers.

The dual-screen cash registers are good for interaction between customers and clerks. In addition to transaction information and orders, advertisements and promotional activities can be shown on the customer display.

TPS680 Fiscal cash register

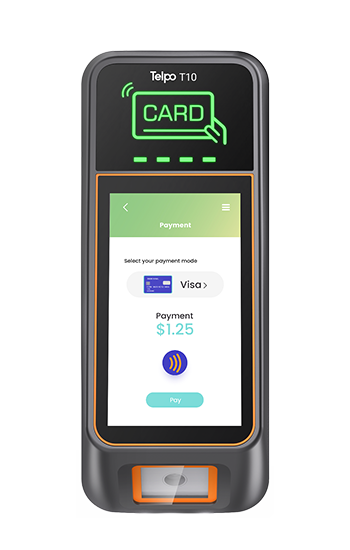

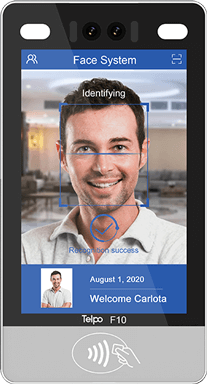

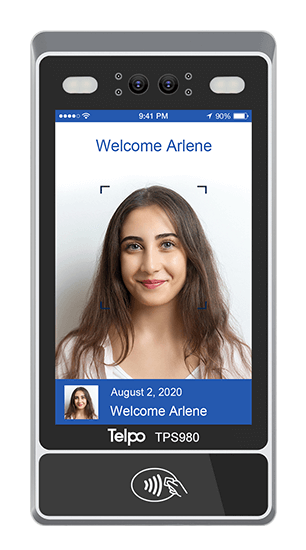

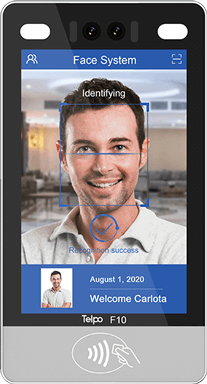

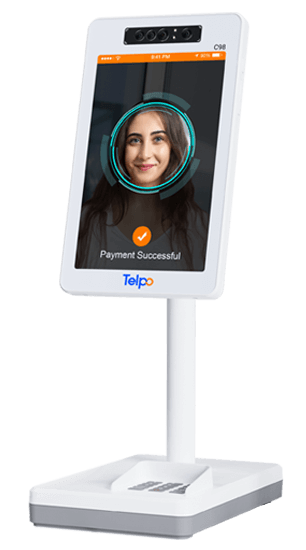

Supporting face payment.

With 3D facial recognition camera, smart cash registers launched by Telpo support financial level face recognition payment. It is much more convenient for customers to consume and pay.

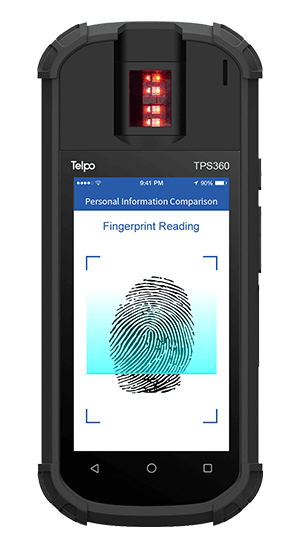

Founded in 1999, Telpo is a world-leading smart terminal and solution provider. With the mission to create a colorful future, Telpo develops a full suite of comprehensive products and solutions for all walks of life. Telpo products cover the smart payment, smart retail, smart security, smart transportation and V-loT field. Telpo is devoted to being your trusted partner.

Tag: fiscal cash register,fiscal device, ecr machine

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)