Biometric technology is no longer limited to border control and security but is more common to apply for customers to pay for their purchases currently. This article will give you a quick start guide on biometric payment.

What is the biometric payment?

Just as its name implies, biometric payment is a payment method using biometrics, such as face recognition, fingerprint, iris, palm, etc. Users don’t have to bring their wallets or smartphones out and could complete the payments for their purchases empty-handed. As everyone has unique physical characteristics, secure payments could be made without users’ need to remember their complex passwords.

What are the types of biometric payments?

The current biometric payments rely on 4 main methods, respectively face recognition payment, fingerprint recognition payment, iris recognition payment and palm recognition payment.

1. Face recognition payment

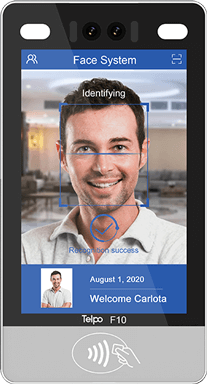

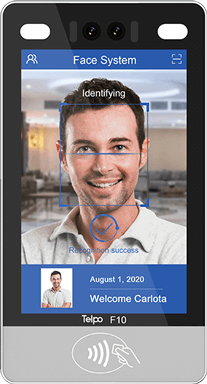

In virtue of a 3D structured light camera and facial image catching, the face recognition algorithm is able to confirm users’ identities through face image comparison and accurately deduct the money from users’ accounts.

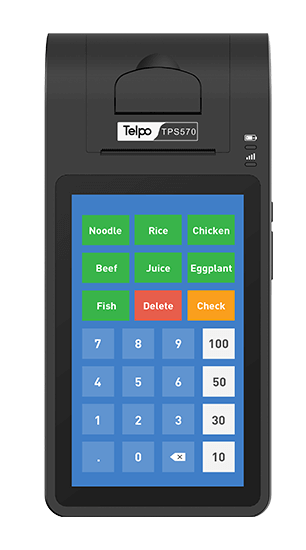

Nowadays, facial recognition payment has been a mature payment method. The 3D structured light camera has been integrated with smart cash registers, self-service kiosks, mobile POS terminals and such hardware and has been applied in various scenarios. Many retailer giants show their recognition to face recognition payments. For example, Carrefour Dubai claims that face biometrics cut their transaction times by 75%.

2. Fingerprint recognition payment

Fingerprint recognition is another reliable method to confirm user identity. Relying on the specialized sensor for fingerprint recognition, users’ fingerprints could be captured and compared to identify the users.

Fingerprint recognition is an identification method for the purpose of security with a long history. The EFT POS launched by Telpo, TPS900, supports live finger detection and ensures the security of biometric payments by fingerprint recognition.

3. Iris recognition payment

Iris recognition payment is a biometric method to complete payments and is said to have the lowest error rate compared to other biometrics. Similarly, iris recognition payments rely upon comparing iris image capture to identify users.

Iris recognition is a common identification method. Users don’t have to take off their hats and masks when being identified. The EFT POS TPS900 mentioned above supports iris recognition as well and makes secure iris recognition payments.

4. Palmprint recognition payment

Palm recognition payment is an emerging biometric payment method in recent years. In 2020, Amazon developed the Amazon One palm-recognition technology, which has been used in Whole Foods Market (Amazon-owned retail chain) for customers to make payments. Now, many payment giants are speeding up palm-recognition payment development.

Palm recognition payment is a senseless payment method, and users could complete their payments by simply placing their palms over the scanner. Through capturing and comparing the palms’ ridges, lines and threads that are unique to each person, identification progress can be easily done. Besides, compared to face images, palm images are less sensitive and palmprint payments are thought to be more secure.

How does biometric payment work?

No matter using what biometric payment method, the processes are alike.

1. Biometric information registration

Customers register their biometric information and bank account information beforehand, either online or offline.

2. Present biometric information

If the customers choose to check out through self-service kiosks, they need to follow the directions of the machines and put their faces, palms, fingers, etc. in the designated area. If the customers choose to check out at the counter, they follow the directions of the cashiers and place the biometric characteristics over the designated scanners.

3. Data comparison

The data captured will be compared with the encrypted data in the database. The comparison will tell whether the identity authentication is approved or declined.

4. Fund transfer

If the customer’s identity authentication is approved, the fund will be transferred to the merchant’s account from the customer’s account. If declined, the fund won’t be transferred.

Biometric payments have been used in more scenarios and users have explored a number of advantages. Would you like to deliver more convenience to your customers? Try biometric payments!

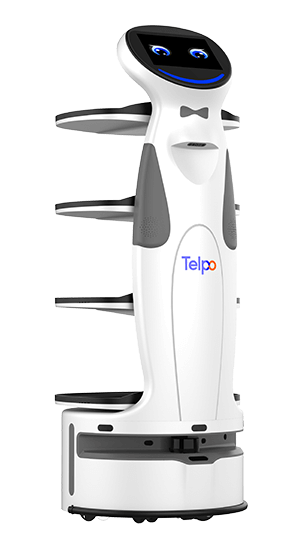

Biometric payments rely on both algorithms and hardware. Hardware should be reliable enough to proceed with the identity authentication process. As a smart terminal and solution provider founded in 1999, Telpo has developed a variety of devices that support biometric payments, such as the self-service kiosk Telpo K8, smart cash register Telpo C8, mobile EFT POS TPS900, etc. Welcome to contact us for more details.

https://www.telpo.com.cn/eft-pos/face-payment-terminal.html

https://www.telpo.com.cn/eft-pos/face-recognition-pos-machine.html

Tag: biometric payment, face recognition payment, palm print payment, biometric technology

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)