Driven by the rapid growth of e-commerce, online ride-hailing, and food delivery as well as the effect caused by the epidemic, Southeast Asia digital payment has seen strong growth, which is expected to exceed the US $1 trillion by 2025. The expansion of payment scenarios also pushes towards the revolution of digital payment, the e-wallet in Southeast Asia is accelerating.

The revolution of digital payment in Southeast Asia

Nowadays, GrabPay, Grab's e-wallet can provide multiple services including in-store purchases, rides, food deliveries, fund transfers, etc. Customers can easily transfer money to friends and family, freely enjoy online shopping, pay with QR codes at offline restaurants and stores, top-up at convenience or retail stores, and even earn GrabRewards points to redeem attractive rewards.

As the expert said the payment terminal helps merchants to complete digital payment while making customers enjoy its seamless and convenient payment experience. Affected by the epidemic, more and more offline stores advocate digital payment as they think it is more hygienic, and scan QR codes to achieve the transaction.

The revolution of digital payment in Southeast Asia

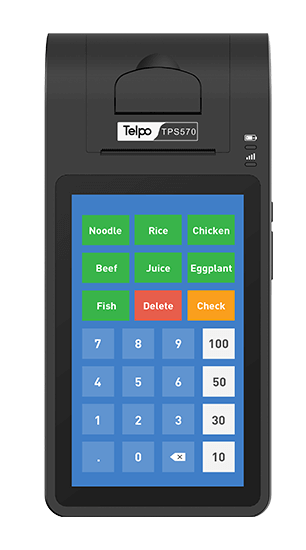

Take Telpo mobile POS TPS320 for instance. Customers can take the initiative to show their payment code, and then merchants can use the mobile POS to receive money and print receipt. Besides, merchants can also present the received code and customers use their mobile phones to scan the QR code for payment.

Telpo TPS320 supports NFC payment, fingerprint payment, IC card, QR-code.

To better cater to consumers' various payment habits, Telpo mobile POS can also support NFC payment, fingerprint payment (optional). Besides, it can also provide member identification, web page printing, label printing, fiscal registration, member points, online ordering, delivery, and other services. In this way, it can help businesses without software development ability to reduce development cycle and cost and speed up deployment and use.

Equipped with the Telpo cloud platform, merchants can remotely manage the mobile POS and obtain real-time order information. With the help of big data, merchants can accurately analyze passenger flow, promote effective marketing, and improve passenger flow and operational efficiency.

Tag: Grab, GrabPay, digital payment, e-wallet, top-up, mobile POS

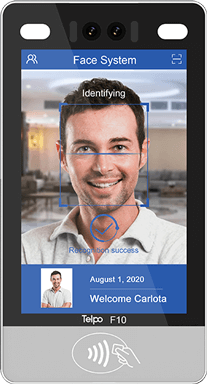

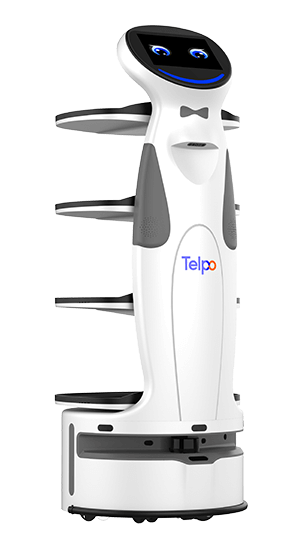

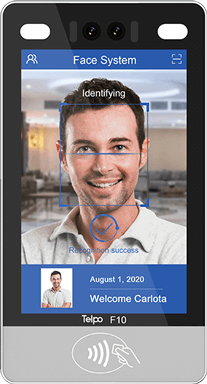

Brief Introduction: Founded in 1999, Telpo is a worldwide first-rate smart terminal and solution provider. It mainly provides EFT-POS, cash registers, biometric devices, facial recognition machines, self-service kiosks, and bus validators. Telpo has served more than 1000 customers abroad, including government, banks, Telecom operators, police stations, Retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)