As one of the intelligent players, India is pushing for smart digital payments. India president Modi promised to further popularize digital payment at home at the address of India Independence Day on 15th August.

It is not the first time that India has generalized using digital payment. India government conducted the concept of digital India a few years ago and advocated Indians use digital payment methods for the daily transaction. Abolishing currency note announced subsequently also accelerated the pace of digital payment in a way.

Data show that using the rate of India digital payment platforms has increased nearly tenfold since the currency note was abolished. Generally speaking, although the weak essence of India's financial system could not change rapidly, abolishing currency note has promoted India financial technology development and brought remarkable promotional effect on digital payment.

Transaction trend in India

Nowadays, every Indian acknowledges E-wallet. Experts believe that demonetized currency note has promoted digital payment publicity in India three years ahead of schedule. However, there are various questions need to be solved for the comprehensive promotion of digital payment around India, while personal accounts and bank terminal devices are the most obvious problems.

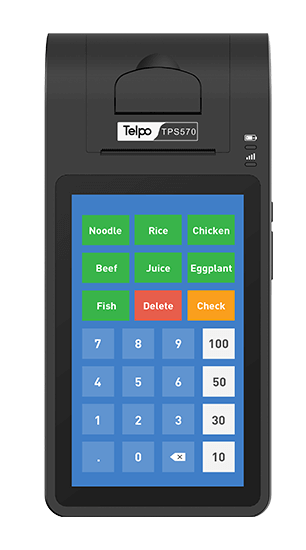

As a smart payment terminal solution partner, Telpo can perfectly handle bank terminal devices such problem.

Telpo smart terminal device TPS900 supports Android 5.1 or above version and adopts 5.5-inch industrial screen and Qualcomm chip, making sure stable operation, superior performance and convenient carrying.

It contains 4400mAh big battery enables consistently work for 24 hours and supports screen standby above 3 days and print 1800 times. It greatly reduces the burden of bank staffs and guarantees the efficient operation of opening accounts, which will further promote the popularization and employment of digital payment in India society.

TPS900 contains 4400mAh big battery.

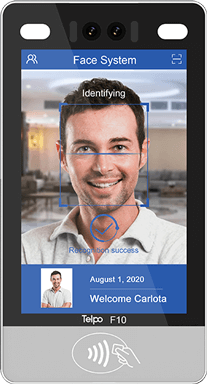

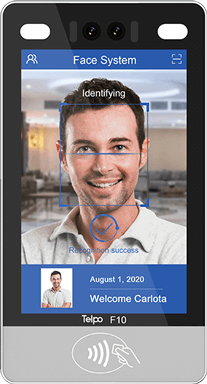

In addition, this smart terminal device not only supports NFC payment、QR code payment but also some smart payment methods equipped with biometric recognition function including fingerprint payment and face payment. More importantly, it obtains EMV, PCI, RUPAY, BIS, and other financial certification further guarantee the transaction security of opening an account.

TPS900 supports IC card payment, NFC payment, QR code payment.

With government strong advocacy of digital payment, Indian society is bound to arouse a new wave of digital payment boom. Telpo will enhance its R&D ability and inventiveness and provide more high-quality terminal devices to help to create a smart cashless payment environment.

Tag: India, digital payment, terminal device, smart payment, currency note

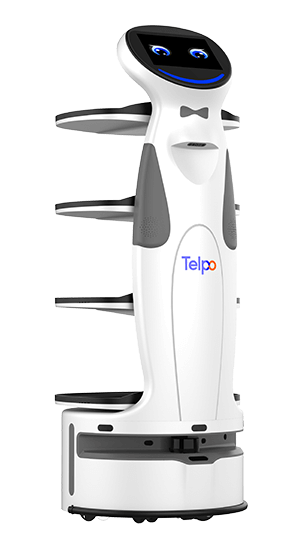

Brief Introduction: Telpo is a professional smart payment partner who mainly provides the EFT-POS, cash registers, biometric device, face recognition machines, self-service kiosks, and bus validators. Telpo has served for more than 1000 customers abroad, including government, banks, Telecom operators, police station, Retail shops, and office. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)