Recently, Japanese Prime Minister Shinzo Abe experienced the first cashless payment method in a commercial street in Tokyo, and said that “the first experience is slightly nervous, but it is really convenient”.

According to the Kyodo News Agency, Abe used an IC card issued by a convenience store to purchase sashimi such as tuna and big belly meat at a fresh fish shop. Later, he purchased a bouquet of roses and other flowers in the flower shop through QR-code. Abe talked to the media about the experience of cashless settlement shopping, saying that “the first experience is a little nervous, but it is really easy to buy.” Kyodo News said that in order to promote Japan's cashless payment, a nine-month point rebate will be implemented from October 2019 to June 2020. If you choose to use a credit card, digital money, etc. to make payments in small and medium-sized stores, the purchaser will receive 5% of the amount spent.

With the prevalence of non-cash payment methods around the world, Japan has gradually promoted cashless payment. But the growth is slower than expected. According to statistic from 2018, Japan’s cashless payment ratio is 20%, and most Japanese consumers are concerned about leaking personal information and privacy, and are more inclined to cash.

The data is considered to be "oil" in the 21st century. Countries are very concerned about CBDC, and the Bank of Japan (BoJ) recently proposed a special research report on CBDC digital currency, but negative support for CBDC.

What is CBDC?

CBDC (Central Bank Digital Currency) or national digital currency is a virtual currency issued and controlled by federal regulators. Therefore, they are fully regulated by the state. Like most cryptocurrencies, CBDCs are not decentralized. Instead, they are just digital forms of fiat money.

As a result, the central bank issuing CBDC not only became the regulator of these currencies but also became the account holder of its clients. Each CBDC unit is similar to the secure digital form of banknotes under Distributed Bookkeeping Technology (DLT).

The CBDC can be seen as a central bank's response to the growing popularity of cryptocurrencies, which are designed to go beyond the authority of regulators, but in turn, CBDC can take advantage of the convenience and security of cryptocurrencies to bring these functions and traditions The combination of time-tested functions of the banking system allows the circulation of these currencies to be both regulated and funded.

As the 2020 Tokyo Olympics is approaching, the promotion of cashless payments will be one of Japan's priorities in 2019. As data payments continue to grow, Japanese concerns about digital security and cryptocurrency payments should be taken seriously and research strengthened.

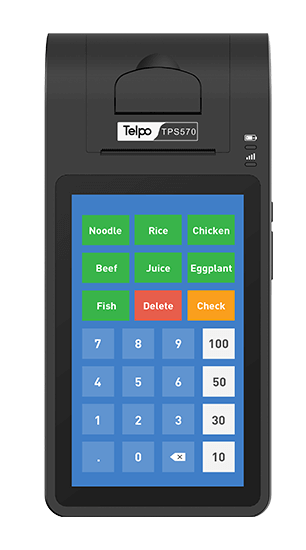

Telpo EFTPOS TPS900 comply with international financial payment standards, such as EMV, PCI, etc., and has been widely sold to more than 100 countries and regions. Telpo Cashless Payment Terminal TPS900 is multi-functional and supports Alipay, Wechat Pay. Telpo has good research and development and production capabilities. Welcome to consult the Telpo Smart POS.

Tag: Cashless Payment, CBDC, digital, Japan, security, Tps900, smart payment

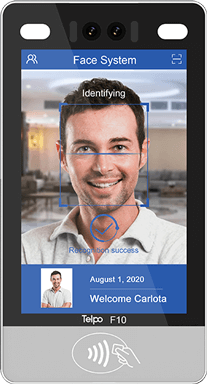

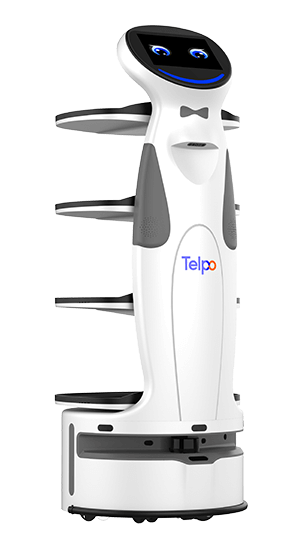

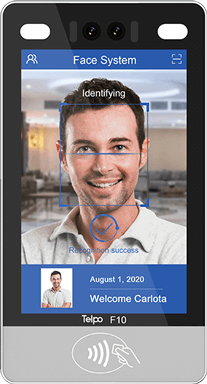

Brief Introduction: Telpo is a professional smart payment partner who focuses on the ODM service 20 years. It mainly provides the EFT-POS, cash registers, biometric devices, face recognition machines, self-service kiosks, and bus validators. Telpo has served for more than 1000 customers abroad, including government, banks, Telecom operators, police stations, retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)