If you want to know what it the major significant factor in fighting against financial crime and money laundering today, KYC (Know Your Customer) should be an indispensable one. As customer identification is the first step to perform every process, it could said to be the most crucial aspect.

The global anti-money laundering (AML) and countering the financing of terrorism (CFT) patterns put the financial institutions in tremendous risk. Under such circumstances, some countries successively take KYC as the preventive measure for client identification.

What Is KYC?

KYC, is the abbreviation of Know Your Customer or Know Your Client. It is the mandatory process to identify and verify the identity of clients before transaction. It can effectively deter criminal behavior like illicitly embezzle user information and use it to make illegal activities or money laundering in bank, and better protect user account and capital security. KYC is used in banks, financial instructions and many other industries according to local government guidelines and regulations.

What Is The Customer Due Diligence Measure?

Customer due diligence is the procedure to build trust with client and assess associated risk, which can be performed at three levels include simplified due diligence, basic due diligence and enhanced due diligence. In bank, the frame of KYC policy will contain customer policy, customer identification procedures (data collection, ID card identification, document verification, sanction lists check, etc), risk assessment and management and ongoing monitoring and record-keeping.

What Is The Advantages of KYC?

l Better build trust in customer profile

l Clearly understand nature of client activities

l Strengthen fraud and loss protection

l Mitigate risk associated with money laundering

l Standardize onboarding process

l Makes it easy to monitor the customer behavior based on risk profile

How Can Telpo Help KYC?

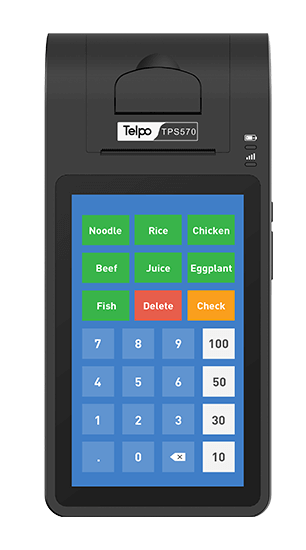

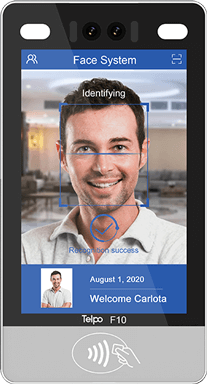

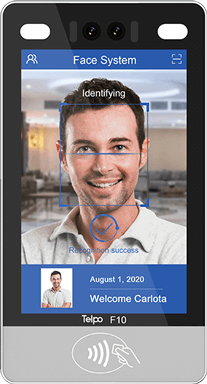

With strong experience in ID verification for governments, banks, operators, biometric companies, Telpo can provide professional identification solution that helps comply with the new rules, particularly those regarding CDD (Customer Due Diligence), KYC obligations, GDPR (General Data Protection Regulation). If you want to know more details, welcome to contact us directly. Telpo Banking KYC

Tag: KYC, KYC meaning, KYC Advantages, CDD, GDPR, AML, CFT, customer due diligence, know your customer, identification

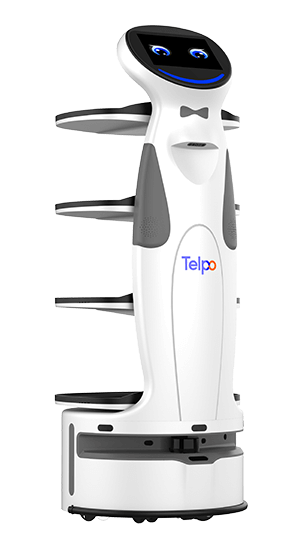

Brief Introduction: Telpo is a professional smart payment partner who focuses on the ODM service 20 years. It mainly provides the EFT-POS, cash registers, biometric devices, facial recognition machines, self-service kiosks, and bus validators. Telpo has served for more than 1000 customers abroad, including government, banks, Telecom operators, police stations, Retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)