In a number of European countries, consumers have rapidly adopted contactless payments. Some banks, retailers and transportation companies have already gone completely cashless, no longer accepting cash at their branches or at the POS. In many countries, making face-to-face payments using a smartphone instead of a card is the next step in the path to a near-cashless society.

MOBILE PAYMENTS VS MOBILE POS

Mobile phones have become an increasingly common tool for making in-store payments, for banking and for buying online. The term “mobile payment” covers all transactions—including peer-to-peer (P2P) transactions, bill payments and ordering items from an e-commerce site—made using any type of mobile phone. “Mobile POS,” on the other hand, refers to face-to-face payments made using a smartphone or tablet wherein the user pays for a product or service on the spot.

Essentially, mobile payment methods are differentiated according to the mobile phone’s ability to work with different types of technologies:

Short message service (SMS) payments, such as those enabled by M-Pesa in Africa, can be made using any mobile phone.

Wireless application protocol (WAP) payments include those made via PayPal as well as QR code payments such as those made through the Starbucks barcode-scanning payment app. These can be made using any smartphone.

Near-field communication (NFC) payments, such as those made via Apple Pay and Samsung Pay, can be made only with smartphones that enable the technology.

The European Central Bank (ECB) considers NFC-based mobile payments among the most promising payment methods for consumers. Suppliers are making consistent investments to update their NFC hardware and merchants are installing contactless points of interaction based on NFC technology.

NFC payments are expected to increase as more consumers adopt the technology. Management consulting company Arthur D. Little estimates that global NFC-enabled smartphone penetration will increase from 23% in 2014 to 72% in 2018.

OUTLOOK: MOBILE PAYMENTS WIDELY AVAILABLE IN EUROPE BY 2020

While payment cards are widely used in Europe, contactless mobile payments are not as popular—as noted earlier, only 3% of in-store payments in Europe were conducted via mobile phone in 2015. Despite the current low mobile payment penetration in Europe, payment system providers are rapidly introducing the infrastructure and secured systems needed to enable mobile payments.

Visa Europe, which is the leading payments system in Europe, with a 57.5% market share in 2015, believes that all Visa POS terminals in Europe will accept contactless NFC payments by 2020.

MasterCard believes that high-value mobile payments will be available across Europe by 2017, thanks to upgrades of contactless payment terminals. Currently, the maximum limit for contactless payments in the UK is £30 (US$46); in many other European countries, it is €25 (US$27). MasterCard also believes contactless payments will be available at all its POS terminals in Europe by 2020.

Visa and MasterCard have both partnered with Apple Pay and Android Pay to develop mobile payment services using Apple and Android devices and to introduce mobile payments in new regions.

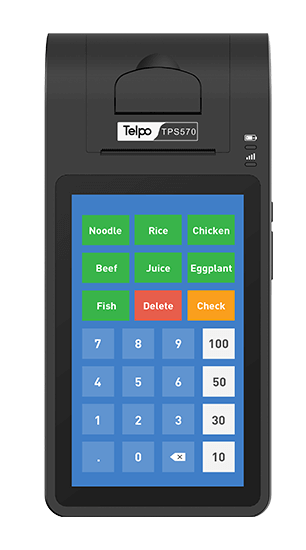

POS TERMINAL FOR CONTACTLESS (NFC) PAYMENT

Telpo TPS900

For contactless (NFC) payment, the merchant must use PayWave & PayPass certified POS terminals. Telpo TPS900 passed EMV, PCI and PayWave &PayPass, supports both contact and contactless payment. Unique fashion design, Android 5.1 OS, with basic function LTE/ Wi-Fi/ Bluetooth/ camera/ MSR+SCR and optional function NFC and fingerprint reader.

Tag: Contactless payments, Mobile Payments, europe, nfc payment

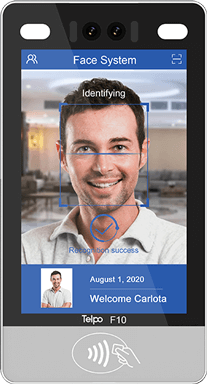

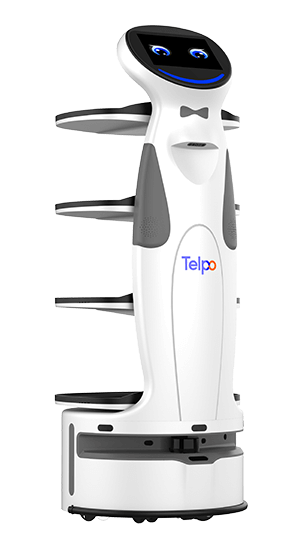

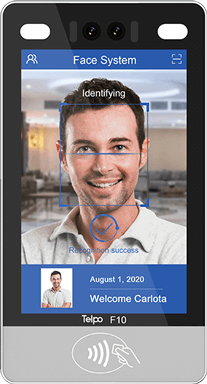

Telpo: We have provided custom service for more than 1000 customers abroad. They are the platform operators, banks, lottery operators, technique companies and even governments organizations. Telpo devotes itself to international rating class banks, lottery centers, tourist halls, hotels, ticket offices, restaurants, retails and many other customizations for different industries.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)