According to a survey released by Boston Consulting Group (BCG), consumer consumption transformation and incumbent banks' customer-friendly behaviors are creating significant opportunities for Southeast Asia emerging and upcoming digital banking.

Southeast is on the cusp of the financial revolution. Particularly affected by the COVID-19 pandemic, digital payment, and home delivery is increasing arise.

What is the current digital payment condition in Southeast Asia?

l Small usage quantity with only 13% of Southeast Asia unbanked urban population use e-wallet.

l E-payment shows strong urban bias in Southeast Asia, particularly in food delivery to homes and offices, taxi transportation and ride-sharing. There is a strong interest among customers to use e-wallet at hawker stands, food courts, and grocery stores.

l Low merchant acceptance caused by poor understanding of processes, complex merchant payment processing, and high fees.

l More than one-third of Southeast Asian surveyed consumers are willing to transfer some of their banking business such as credit cards and loans to nonbank digital players.

Why digital payment is crucial?

Digital transformation is driving around the world. The number of globally e-wallet users rose from 500 million to 2.1 billion in just two years, and 70% among them belong to China and India, 12% account for Africa and the Middle East. That means, the developing nations account for most of that growth, and Southeast Asia should not fall behind.

The underdeveloped and fractioned traditional consumer financial services also drive developing countries to make transformations. In many countries, it is hard for consumers to get credit cards from banks because they fail to verify borrowers' creditworthiness. Although the credit card is available, some merchants will reject accepting it because of high fees. Cash transaction is convenient and uncleanness. Besides, it is also hard to find ATM to make withdrawals with time-consuming bank account registration electronic transactions.

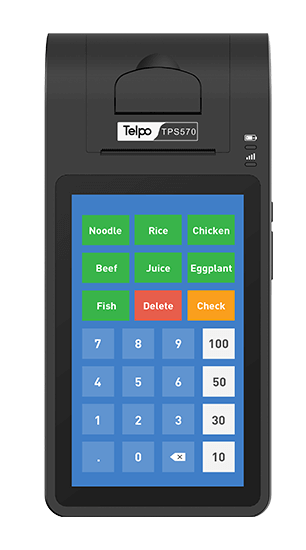

Digital Payment Smart POS device TPS900

Why Southeast might embrace the digital payment revolution?

First, the COVID-19 outbreak and its aftermath are expected to drive more Southeast Asian households to embrace digital payments. E-wallets can be seen as a safer shopping way. In the first few months after the outbreak, digital payment transactions is sharply increasing especially in food and grocery home deliveries in Thailand, the Development Bank of Singapore reported.

Second, many innovative and convenient payment solutions are emerging. For example, Alipay e-wallet has more than 600 million monthly active users, and Tencent's WeChat Pay has about 900 million users.

QR-code Payment Mobile POS TPS320

Third, many countries are encouraging the development of digital payment infrastructure to promote financial inclusion. Thailand has launched a real-time retail payment system, PromptPay, which allows free, instant, and highly secure transactions. Several Southeast Asian countries, including Singapore and Thailand, have made good progress in standardizing QR codes.

Fourth, the Southeast owns many key characteristics that fueled the rapid evolution and development of digital payments. Namely, high digital penetration and digital engagement, friction between consumers and commercial banks, startups and digital platforms investment, e-payment user steady expansion and strong government support.

Across Southeast Asia, more than 70% of millennials will connect to the internet. And Southeast Asian consumers are among the most digitally engaged in the world, nearly per person of Thai, Malaysian, or Indonesian will spend four hours per day. CCI estimates that more than a 174million adults across the region lack bank accounts or credit cards, while another 30 million make minimal use of banks. That means Southeast Asia has extensive potential to embrace digital transformation and the digital payment market.

Last but not least, Southeast Asian governments and regulators are pushing for the digitization of financial transactions. Although their payment infrastructure is not well enough, they are trying to fix it and develop an instant retail payment system. In 2018, the Philippines launched InstaPay, a national retail payment system. Indonesian banks are promoting chip-based value cards as an alternative to cash, and the government has set up a national payment gateway aimed at ensuring connectivity and interoperability of domestic retail payment tools.

Above all, these characteristics give a big boost to the development of digital banking in Southeast Asia and might help them embrace the digital payment revolution as soon as possible.

Tag: digital payment, payment revolution, e-wallet, Southeast Asia, POS device

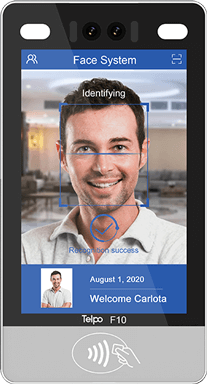

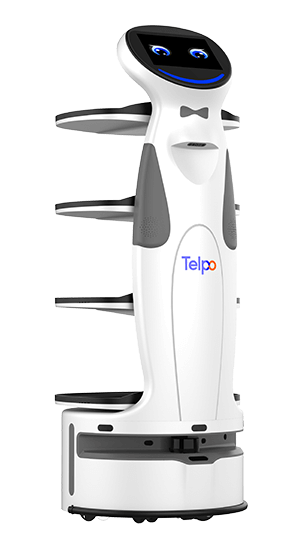

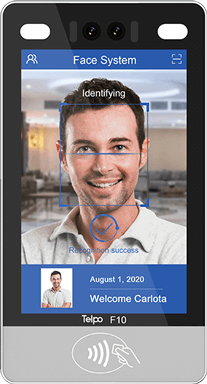

Brief Introduction: Founded in 1999, Telpo is a worldwide first-rate smart terminal and solution provider. It mainly provides EFT-POS, cash registers, biometric devices, facial recognition machines, self-service kiosks, and bus validators. Telpo has served more than 1000 customers abroad, including government, banks, Telecom operators, police stations, Retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

Related Products: TPS320、M1, TPS900

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)