Banking is an industry with extremely high risk of financial fraud and money laundering, so it is necessary to perform a background investigation on customers to mitigate fraudulent or misuse activities.

Background

In the past, if a customer wants to open an account, the bank staff will generally compare the customer's face with a picture on the ID card. However, it will undoubtedly increase the bank staff burden on identifying identification as it is hard to recognize whether personnel information is real with similar faces and poor handwriting. Besides, it will enhance the potential risk of information leakage caused by documents lost or stolen.

Introduction

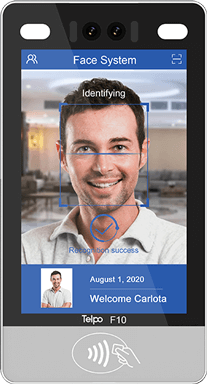

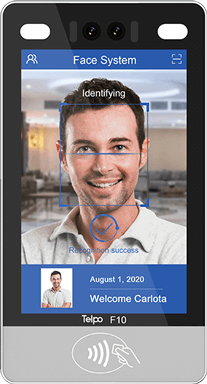

KYC is quite a safe, effective and mandatory method to verify customers’ identification and behavior, which has widely recognized by governments and financial institutions. Aiming to provide a smooth customer onboarding experience that complies with KYC regulations and minimizes the risk of fraud, Telpo launched a banking KYC solution or called ID verification solution recently.

Compared with the traditional verification process, Telpo will offer a biometric terminal to enable bank staff to take a customer's picture or capture his fingerprint to compare with ID card. With unique and specific biometric characteristics, personnel identification will be truly recognized. And the e-document service will certainly ease staff burden on managing and keeping personnel information.

The encryption technology is conductive to protect user account and identification, reduce the risk of identity theft, money laundering, financial fraud, and the financing of criminal organizations.

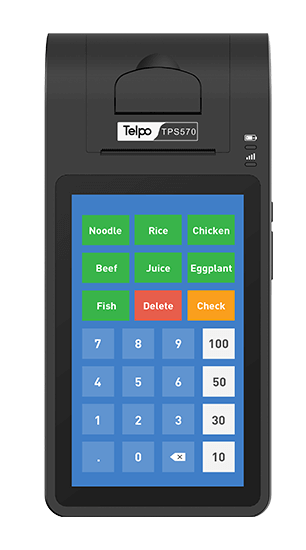

Biometric Terminal

KYC biometric terminal usually contains a fingerprint scanner, camera, etc, which can timely transfer user’s personnel information and authorized signatures to the platform or compare the authenticity with the database of established identities.

Take Telpo biometric terminal TPS360 as an example. It adopts FBI PIV and FBI Mobile ID certified FAP20 optical scanner, which supports multi-dynamic range (MDR) technology, live fingerprint detection (LFD) technology. Importantly, it complies with NIST certified interoperable image & template format standards (ANSI-378, ISO19794-2/4) and image compression standard (WSQ), ensuring collect and record user fingerprint in a fast, safe, and efficient way.

TPS470 service as the Enrollment Tablet for guests

Multiple scanner & card reader modules can be chosen include NFC scanner, smart card reader, secure access module (SAM) card reader, front& back camera, etc. As different countries have various demands on opening an account, it will be better to choose the most suitable configuration. If you want to more details, welcome to contact us directly.

Tag: KYC, KYC solution, bank, biometric terminal, ID verification fingerprint technology, e-document

Brief Introduction: Telpo is a professional smart payment partner who focuses on the ODM service 20 years. It mainly provides the EFT-POS, cash registers, biometric devices, facial recognition machines, self-service kiosks, and bus validators. Telpo has served for more than 1000 customers abroad, including government, banks, Telecom operators, police stations, Retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-good-look-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)