As cryptocurrencies such as Bitcoin have prevailed worldwide, countries are seriously considering whether issue their own national digital currencies. Recently, the National Bank of the Republic of Kazakhstan has published a public consultation document as part of its plans to develop and pilot a central bank digital currency (CBDC).

What is Digital Currency?

According to the Wikipedia definition, digital currency (digital money, electronic money, or electronic currency) means any currency or money that is majorly managed, stored, or exchanged on digital computer systems, especially over the internet.

Today, the most widely-used form of digital currency should be cryptocurrency Bitcoin. It mainly uses technologies such as smartphones, credit cards to make an exchange with online cryptocurrency. In some cases, it can be transferred into physical cash, for example by withdrawing cash from an ATM.

The benefit of Issuing Digital Currency

l Widen the range of options for monetary policy

l Make the financial system safer

l Encourage competition and innovation in the payment system

l Recapture a portion of seignorage and address the decline of physical cash

l Help address the implications of alternative finance upon money creation and distribution

l Improve financial inclusion

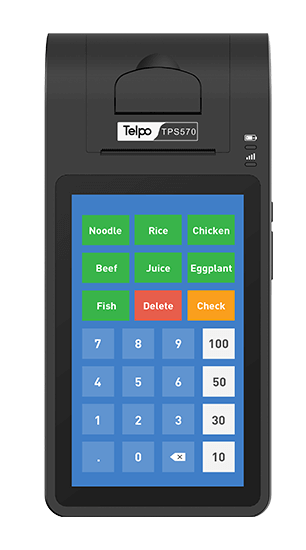

Telpo Digital Payment POS device

The rising of digital currency is essentially the replacement of physical cash and another attempt at digital payment. When it comes to digital payment, the multifunctional EFT-POS TPS900 could be a good choice.

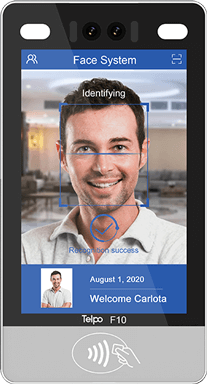

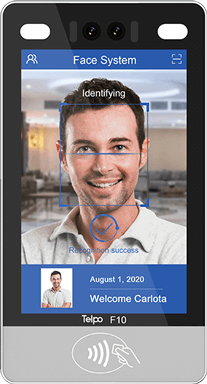

The POS terminal not only supports financial credit card transactions, but also compatible biometric payment (face payment, fingerprint payment), contactless NFC payment (Mifare), and QR Code payment.

What makes it better, it possesses multiple financial certificates to maximum guarantee commercial transaction security, including PCI 6.X, EMV, PCI, Paywave, Paypass, MIR, Rupay, TQM, CE, FCC, RoHS, BIS, Anatel, etc. The OTG, UHF, TPUI, physical keyboard, and tax control module are available to expand its practicability, making it suitable to be used in various commercial transaction scenarios.

Tag: digital currency, digital payment, POS device, cryptocurrency, EFTPOS, the central bank

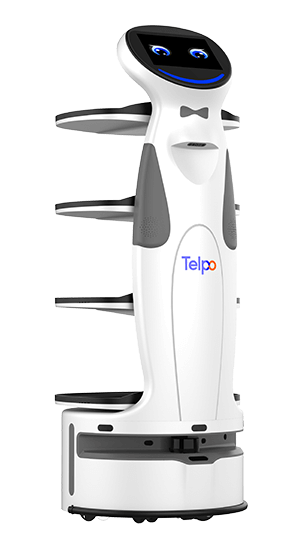

Brief Introduction: Founded in 1999, Telpo is a worldwide first-rate smart terminal and solution provider. It mainly provides EFT-POS, cash registers, biometric devices, facial recognition machines, self-service kiosks, and bus validators. Telpo has served more than 1000 customers abroad, including government, banks, Telecom operators, police stations, Retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)