Introduction: Why Digital Trust Needs a New Foundation

Financial crime losses continue to rise worldwide, fueled by synthetic identity fraud, document forgery, and AI-powered impersonation attacks. Traditional KYC methods—passwords, PINs, and document-based checks—are increasingly unable to secure digital services at scale. As organizations accelerate remote onboarding and cross-border operations, a biometric verification solution is emerging as a critical trust infrastructure. By binding identity to unique human characteristics, biometric identification and verification enable next-generation KYC that is more accurate, resilient, and user-friendly across banking, telecom, healthcare, and other regulated industries.

Why Traditional KYC Fails in the Era of Digital Fraud

Traditional identity checks were never designed for today’s threat landscape.

Passwords can be shared, documents can be forged, and identities can be synthetically generated using stolen or fabricated data. As fraud techniques evolve, legacy KYC systems struggle to detect impersonation, account takeovers, and unauthorized access—especially in remote or self-service scenarios.

Key limitations include:

-

Static credentials vulnerable to leaks and phishing

-

Document-based verification exposed to high-quality forgeries

-

Poor scalability for high-volume digital onboarding

These gaps have pushed enterprises to rethink identification and verification in biometrics as a more reliable alternative.

How a Biometric Identification and Verification Solution Strengthens Modern KYC

Biometrics anchors identity to the human body itself.

A biometric identification and verification solution leverages physiological traits such as facial features, fingerprints, palm patterns, or irises to establish identity with a level of certainty traditional methods cannot match.

Core advantages include:

-

Uniqueness: Biometric traits are highly individualized and extremely difficult to replicate

-

Accuracy: Advanced algorithms deliver low FAR and FRR, even at scale

-

Fraud resistance: Liveness detection prevents spoofing using photos, videos, or fake fingerprints

This is why biometric security companies are increasingly supporting national ID programs, financial institutions, telecom operators, and healthcare providers worldwide.

Cross-Industry KYC Scenarios Enabled by Biometric Verification

One trust layer, adaptable across industries.

Banking KYC with Fingerprint Scanner for Banking

Biometrics improves compliance while reducing onboarding friction.

Banks rely on biometric identification and verification to prevent identity theft, meet AML regulations, and streamline customer onboarding. A fingerprint scanner for banking equipped with live fingerprint detection (LFD) ensures that only real, present users are authenticated—even when fingers are wet or dirty.

A mobile fingerprint scanner tablet enables:

-

Rapid 1:N identification in branches or field operations

-

Interoperability with global systems via ISO19794-2 and ANSI378 templates

-

Secure, compliant KYC without sacrificing user experience

Telecom Subscriber Verification Using Rugged Android Tablet

Biometrics enforces real-name registration and combats SIM fraud.

Telecom operators face challenges such as SIM swap fraud, anonymous prepaid usage, and identity abuse. A portable tableta android robusta allows field agents to conduct on-site subscriber verification using fingerprints, NFC ID cards, and facial image capture.

Devices like Telpo S9 combine durability, long battery life, and multimodal biometrics, making them ideal fingerprint scanner tablets for outdoor or remote telecom deployments.

Healthcare Identity Verification with Facial Recognition Hardware

Accurate patient identification without added friction.

In healthcare, identity errors can lead to duplicate records, insurance fraud, or incorrect treatment. Facial recognition hardware enables fast, contactless patient verification—especially valuable in hygiene-sensitive environments.

A dedicated facial identification terminal ensures:

-

Accurate patient matching

-

Reduced administrative burden

-

Secure access to medical services

Purpose-Built Hardware for Real-World Biometric KYC

Reliable algorithms require equally reliable devices.

S9 Rugged Mobile Biometric Tablet

A field-ready biometric verification solution.

The S9 is a tableta android robusta designed for mobile and field-based KYC scenarios, combining fingerprint recognition, NFC, and camera-based identity capture in one rugged device.

Key features:

-

FBI-certified fingerprint technology with LFD

-

500 DPI high-resolution sensor

-

Multimodal support: fingerprint, rear camera portrait capture, NFC

-

IP65 protection, 1.2m drop resistance

-

Optional 10,000mAh battery for extended operation

Explore the S9 fingerprint scanner tablet: https://www.telpo.com.cn/biometric-device/mobile-biometric-tablet

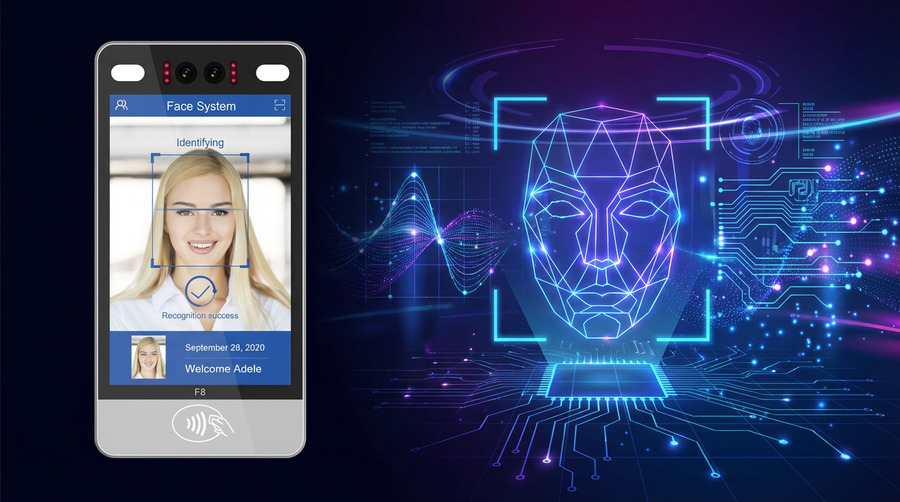

F8 Facial Identification Terminal

High-capacity facial recognition for high-traffic KYC.

The F8 is a powerful face detection machine supporting Android or Linux systems and up to 30,000 registered users.

Highlights include:

-

IR + RGB dual-lens camera

-

0.01% FAR with liveness detection

-

Built-in NFC reader

As a facial recognition reader, the F8 enables fast and secure KYC verification in banks, hospitals, and access-controlled environments.

P105 Palm Recognition Terminal

Next-generation contactless biometric authentication.

The P105 introduces advanced palmprint and palm vein recognition, delivering exceptional accuracy and anti-spoofing protection.

Key advantages:

-

Android OS with octa-core processor

-

Dual contactless options: palm recognition and under-display NFC

-

IP54-rated durability

Palm-based biometrics further expand identification and verification in biometrics, especially for high-frequency, contactless authentication scenarios.

Beyond Devices: Telpo’s Customizable Biometric Authentication Solution

Hardware tailored to your operational reality.

Telpo designs and manufactures biometric hardware solutions that adapt to diverse regulatory and operational needs across industries. Its portfolio includes fingerprint, facial, palm, and iris recognition terminals, along with extensive customization options.

Customization capabilities include:

-

Fingerprint sensors compliant with various FAP performance standards

-

Optional smart card readers, MZR readers, and NFC modules

-

Multi-modal biometric configurations for complex workflows

Discover Telpo’s full biometric authentication solution portfolio.

Building the Future of KYC and Digital Trust

As digital services scale across industries, KYC is no longer just a compliance requirement—it is the foundation of digital trust. A biometric verification solution provides a future-proof approach by combining uniqueness, accuracy, and fraud resistance into a unified identity layer.

With multi-modal biometric hardware and deep customization capabilities, Telpo helps banks, telecom operators, and healthcare providers build secure, compliant, and scalable KYC systems. Visit Telpo to explore how biometric verification can power your next-generation KYC strategy.