El ecosistema de pagos moderno está evolucionando rápidamente, impulsado por la adopción generalizada de los pagos sin contacto y las exigencias normativas cada vez más estrictas en materia de seguridad de las transacciones, como las normas PCI DSS 4.0. Este entorno dinámico impone exigencias significativas a los fabricantes y proveedores de terminales de pago, lo que hace que la seguridad, el cumplimiento y la compatibilidad sean más críticos que nunca. Este artículo aclara las principales diferencias entre un financiero terminal de pago (también conocido como Micro ATM, Máquinas EDC, terminales de pago con tarjeta de créditoo terminales de tarjetas de crédito) y un Terminal punto de venta inteligente. Demuestra cómo las capacidades de Telpo -respaldadas por tecnologías avanzadas de cifrado, un estricto cumplimiento de las normas financieras y una personalización flexible- garantizan que sus productos cumplen los elevados umbrales de producción de terminales de pago financieros.

Principales diferencias entre los TPV de pago y los TPV inteligentes generales

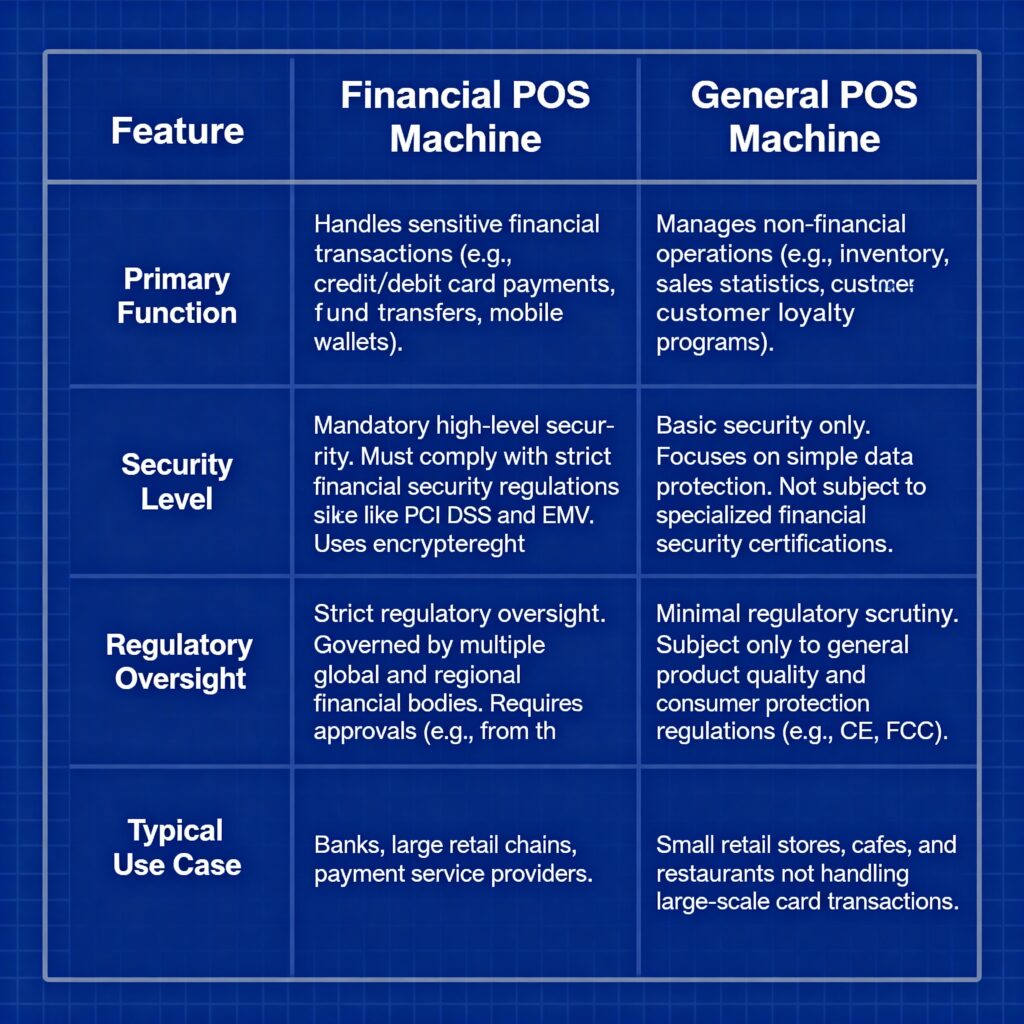

Comprender la distinción entre una TPV de transacciones y un TPV general es primordial para cualquier empresa que maneje datos de pago confidenciales. Aunque puedan parecer similares, sus funciones, protocolos de seguridad y requisitos normativos son fundamentalmente diferentes.

A. Enfoque funcional y transaccional

-

Máquinas financieras de pago: La función principal de estos dispositivos es gestionar transacciones financieras sensibles. Esto incluye pagos con tarjeta de crédito/débito, transferencias de fondos y pagos digitales sin contacto (por ejemplo, NFC, monederos móviles). Son el hardware esencial para garantizar la seguridad de las transacciones monetarias en bancos, grandes cadenas minoristas y proveedores de servicios de pago. Por ejemplo, en un proyecto a gran escala en Nigeria, Telpo se asoció con un actor regional para diseñar, producir y suministrar tarjetas de pago específicas. TPV EFT que ahora procesan miles de pagos diarios con tarjeta, garantizando la liquidación de fondos en tiempo real y el registro seguro de las transacciones dentro del sistema financiero del país.

-

Máquinas generales de TPV: Estos dispositivos se centran en operaciones no financieras como la gestión de inventarios, las estadísticas de ventas, la venta móvil de entradas y el seguimiento de programas de fidelización de clientes. Suelen utilizarse en pequeños comercios minoristas (por ejemplo, tiendas de regalos) y establecimientos de restauración en los que la necesidad principal es la eficiencia operativa, no el cifrado financiero avanzado. Una cafetería local, por ejemplo, utiliza una máquina TPV general para registrar las ventas diarias de bebidas y gestionar los niveles de existencias de café en grano, sin necesidad de las funciones de seguridad avanzadas de un terminal financiero.

B. Requisitos de seguridad

-

TPVs Financieros: La seguridad de alto nivel es un requisito obligatorio. Estos dispositivos para tarjetas de crédito deben cumplir estrictas normativas de seguridad financiera como PCI DSS (Payment Card Industry Data Security Standard) y las especificaciones EMV. El cifrado de los datos confidenciales de los titulares de tarjetas y de los PIN no es negociable, ya que cualquier violación de la seguridad puede acarrear enormes pérdidas económicas y responsabilidades legales. Las principales características de seguridad incluyen cuerpos cifrados, chips de cifrado seguros y cifrado de software multicapa para evitar la filtración y manipulación de datos. También requieren certificaciones específicas de instituciones financieras, como Visa PayWave y Mastercard PayPass.

-

Máquinas generales de TPV: Estos terminales móviles sólo requieren una protección básica de los datos, como la protección por contraseña de los registros de ventas. No están sujetos a certificaciones especializadas de seguridad financiera, por lo que no son aptos para manejar datos financieros sensibles.

C. Restricciones reglamentarias

-

TPVs Financieros: Los TPV financieros están sujetos a una estricta supervisión reglamentaria por parte de múltiples organismos reguladores financieros mundiales y regionales. Por ejemplo, en la UE, deben cumplir el GDPR para la protección de datos, mientras que en China, deben cumplir los requisitos de la "Especificación de Seguridad de Terminales de Pagos Financieros" del Banco Popular de China. El acceso al mercado de estos dispositivos requiere la aprobación de las autoridades, y las auditorías periódicas de cumplimiento son obligatorias.

-

Máquinas generales de TPV: Estos dispositivos están sujetos a un escrutinio normativo mínimo, ya que normalmente sólo necesitan cumplir la normativa general de protección de los consumidores y de calidad de los productos (por ejemplo, la certificación CE o FCC para productos electrónicos). El umbral de entrada en el mercado es significativamente más bajo, ya que no existe un examen reglamentario en profundidad y específico de las finanzas.

Principales capacidades de Telpo como proveedor y fabricante profesional de terminales de punto de venta (TPV) financieros

El protagonismo de Telpo como proveedor de terminales de punto de venta portátiles se asienta sobre una base de superioridad tecnológica, cumplimiento riguroso y personalización centrada en el cliente.

A. Tecnología avanzada de cifrado: Protección de todas las transacciones financieras

Los TPV financieros de Telpo se han diseñado con una sólida seguridad en su núcleo.

-

Chip de encriptación y cuerpo encriptado: Nuestro hardware está equipado con chips de cifrado seguros de estándar internacional (conformes con las normas EMV y PCI PTS) y un diseño de cuerpo cifrado resistente a las manipulaciones. El chip seguro almacena claves criptográficas sensibles y realiza operaciones de cifrado en un entorno aislado, mientras que el cuerpo cifrado impide el desmontaje físico y la manipulación, bloqueando eficazmente los ataques maliciosos al hardware. Desde el momento en que se pasa o se toca una tarjeta, el chip de encriptación cifra los datos en tiempo real, y el diseño físico garantiza que los componentes internos permanezcan seguros.

-

Sistema de cifrado y tecnología de claves: Telpo integra un sofisticado software para complementar su hardware seguro. Admitimos los algoritmos de cifrado simétrico estándar del sector (DES, 3DES, SM4, AES) para un cifrado eficaz y de gran volumen de datos de transacciones. Para el intercambio seguro de claves, adoptamos algoritmos de cifrado asimétrico como SM2 (norma nacional en China) y RSA. Además, nuestra aplicación del Dukpt (Clave única derivada por transacción) garantiza que se genera una clave única para cada transacción, lo que supone un nivel de seguridad añadido.

B. Cumplimiento financiero estricto y certificaciones autorizadas

El compromiso de Telpo con el cumplimiento está validado por una amplia cartera de certificaciones mundiales. Hemos obtenido toda una serie de certificaciones financierasincluyendo:

-

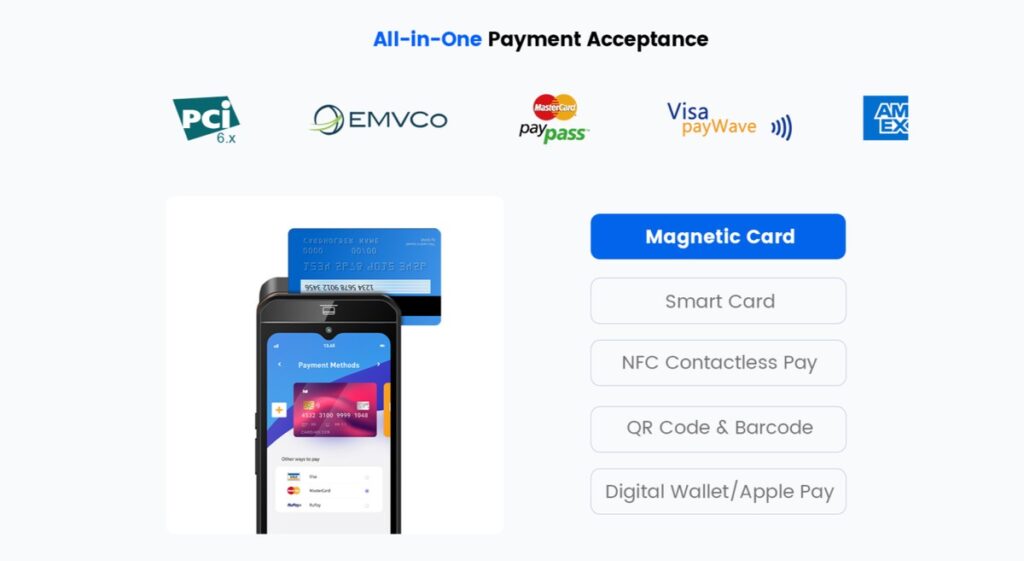

STP DE LA PCI (Industria de tarjetas de pago - Punto de venta): Esta certificación, que abarca los dispositivos de introducción de PIN y los terminales de punto de venta, valida nuestro cumplimiento de las normas más estrictas de seguridad para los datos de las tarjetas.

-

Certificación EMV L1/L2: De este modo, nuestros terminales son compatibles con las normas mundiales sobre tarjetas IC, lo que garantiza transacciones seguras y sin problemas en todo el mundo.

-

Certificaciones financieras de nivel 3: Telpo cuenta con la certificación de las principales redes, incluidas American Express y Discover, además de una amplia experiencia con EMV, PayPass, PayWave y PURE.

Asociarse con una entidad financiera certificada Proveedor de máquinas de TPV como Telpo elimina los riesgos de cumplimiento para los clientes, garantizando que sus terminales de punto de venta puedan acceder sin problemas a redes de pago globales como Visa y Mastercard, al tiempo que cumplen los requisitos normativos locales.

C. Gran compatibilidad y soluciones de hardware personalizadas

Telpo ofrece una gran compatibilidad y servicios de personalización flexibles para satisfacer las diversas necesidades del mercado.

-

Compatibilidad con diversos sistemas de pago: Nuestras máquinas de tarjetas para TPV admiten una integración perfecta con los principales sistemas de pago mundiales, incluidas las redes de tarjetas de crédito (Visa, Mastercard, UnionPay, American Express) y los métodos de pago digitales emergentes (Apple Pay, Google Pay, Alipay+). Nuestros terminales también son compatibles con varios protocolos de comunicación (4G LTE, Wi-Fi 6, Bluetooth 5.3) para adaptarse a diferentes entornos de tienda. Como socio profundo de Alipay+, Telpo ha personalizado varios terminales de pago inteligentes que incorporan tecnología de reconocimiento facial, NFC y código QR.

-

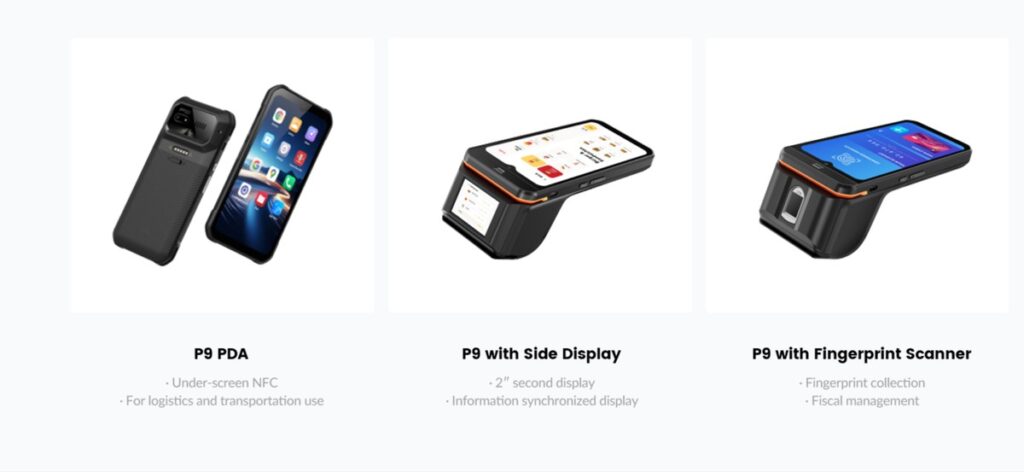

Servicios de personalización: Telpo ofrece soluciones a medida para necesidades profesionales. Esto incluye la personalización del hardware, como añadir una impresora térmica integrada para recibos, una pantalla táctil de alta definición para operaciones complejas o una carcasa reforzada para entornos difíciles. En Telpo P9por ejemplo, presenta un diseño resistente al polvo y al agua, ideal para operaciones bancarias al aire libre. Del mismo modo, para un cliente que necesitaba un dispositivo compacto y rentable para un mercado local, el equipo de Telpo llevó a cabo una meticulosa investigación para desarrollar el altamente adaptable TPV Android Telpo P8 serie. También se puede personalizar el software, por ejemplo, con idiomas localizados, integración con sistemas ERP existentes y funciones de seguridad personalizadas, como tiempos de espera para introducir el PIN.

Telpo P9 dispone de una amplia gama de opciones de configuración para satisfacer las necesidades de la industria

Descifrando los umbrales de la producción de terminales de pago financieros y las soluciones de Telpo

La producción de terminales de punto de venta financieros es un proceso complejo con elevados umbrales técnicos y de control de calidad. El enfoque integrado de Telpo nos permite superar estos retos con eficacia.

A. Umbral de conocimientos técnicos

-

Capacidad interna de I+D: El equipo de I+D de Telpo para TPV financieros está formado por más de 150 ingenieros especializados en algoritmos de cifrado, diseño de hardware (con experiencia en hardware antimanipulación) y protocolos de pago (EMV, normas PCI PTS). Los profundos conocimientos de nuestro equipo sobre el cifrado asimétrico y el sistema de claves Dukpt dan fe de nuestra capacidad técnica.

-

Actualizaciones tecnológicas continuas: Invertimos 15% de nuestros ingresos anuales en I+D, centrándonos en tecnologías emergentes como la detección del fraude basada en IA para identificar transacciones anómalas y la conectividad IoT para alertas de fraude en tiempo real. Estas actualizaciones no solo mejoran la experiencia del usuario con velocidades de transacción más rápidas, sino que también mejoran significativamente la seguridad.

B. Umbral de control de calidad

-

Procesos de fabricación rigurosos: Mantenemos un riguroso control de calidad desde el principio. Solo utilizamos componentes de calidad A de proveedores certificados (por ejemplo, chips de cifrado de NXP, procesadores de Qualcomm), con inspección de entrada 100%. Nuestro proceso de fabricación de 5 pasos (montaje SMT → pruebas de hardware → grabación de software → inyección de claves de cifrado → montaje final) incluye supervisión de calidad en tiempo real mediante sensores IoT y un inspector de calidad dedicado en cada etapa, lo que garantiza el cumplimiento de las normas ISO 9001 e ISO 14001.

-

Procedimientos de prueba rigurosos: Nuestros terminales se someten a pruebas exhaustivas. Las pruebas de seguridad incluyen pruebas de penetración y de manipulación física para garantizar la resistencia a todos los métodos de ataque habituales. Nuestras pruebas de rendimiento incluyen más de 10.000 pruebas de transacciones continuas para verificar la estabilidad y la compatibilidad con las principales tarjetas de pago, garantizando que no se produzcan fallos en la lectura de tarjetas.

Tecnología profesional de interacción con tarjetas de Telpo: Transacciones seguras con tarjetas IC y de banda magnética

A. Proceso de transacción de tarjetas EMV (impulsado por el software RKI)

Propiedad de Telpo Software RKI (Remote Key Injection) optimiza el proceso de transacción de tarjetas EMV. El flujo de trabajo se inicia con la inicialización de los parámetros del terminal, seguida de la detección de la tarjeta (distinguiendo las tarjetas IC de las de banda magnética) y la selección de la aplicación. A continuación, la transacción se completa con el cifrado de datos y la transmisión a la pasarela de pago. El software RKI optimiza este proceso, reduciendo los pasos de interacción en 15% y acortando el tiempo total de la transacción a menos de 3 segundos.

B. Garantía de seguridad para las transacciones con tarjeta

Los terminales de punto de venta de Telpo admiten la autenticación de datos sin conexión (ODA) mediante SDA (autenticación estática de datos) y DDA (autenticación dinámica de datos). Mientras que la SDA verifica los datos estáticos de la tarjeta para evitar su manipulación, la DDA utiliza firmas dinámicas generadas por el chip de la tarjeta, lo que proporciona un mayor nivel de seguridad contra la copia de tarjetas. En un escenario real, si se utilizara una tarjeta de banda magnética falsificada, nuestro terminal detectaría la falta de coincidencia de datos mediante DDA, finalizando inmediatamente la transacción y evitando pérdidas económicas.

C. Diferencias entre tarjetas IC y tarjetas de banda magnética (desde el punto de vista del hardware)

-

Tarjetas de banda magnética: Estas tarjetas almacenan los datos en una banda magnética, que puede leerse y copiarse fácilmente con dispositivos sencillos. Aunque los terminales de punto de venta de Telpo admiten transacciones con banda magnética, añaden una capa adicional de seguridad, como la verificación en tiempo real del código CVV de la tarjeta, para mitigar los riesgos.

-

Tarjetas IC: Estas tarjetas almacenan datos en un chip incorporado y requieren una autenticación compleja (como la DDA) durante las transacciones. Los terminales de Telpo están equipados con lectores de tarjetas compatibles con EMV que pueden interactuar con los chips IC para completar la autenticación cifrada, lo que hace prácticamente imposible copiar la tarjeta.

Póngase en contacto con Telpo para obtener soluciones a medida

En una era de rápidos cambios, en la que el pago sin contacto, las estrictas normas de seguridad como PCI DSS 4.0 y la demanda de soluciones de punto de venta personalizadas están dando forma a la industria del hardware financiero, Telpo destaca como una empresa fiable y profesional. fabricante y proveedor de TPV de pago. Nuestra amplia experiencia, nuestras sólidas funciones de seguridad y nuestro compromiso inquebrantable con el cumplimiento de las normativas y la personalización nos convierten en un socio de confianza para empresas e instituciones financieras de todo el mundo.

Damos la bienvenida a las empresas que necesitan Producción y personalización de máquinas de punto de venta para ponerse en contacto con nuestro equipo profesional y obtener una consulta técnica gratuita y una propuesta de solución a medida.