In addition to guaranteeing the revenues of the government from taxes, business data are an important economic indicator reflecting consumer trends and economic health. As digitization increased, it has become much easier for businesses to manipulate business data secretly, which has added to the tax authorities’ difficulty. How to record business data accurately and efficiently? A fiscal cash register is needed.

A fiscal cash register is equipped with a tax storage, which keeps recording daily business data and tax payable. The data that the tax storage records can’t be changed or erased. Don’t attempt to remove the tax storage from the cash register. It is impossible. The tax storage is fixed inside the fiscal cash register with special sealing means, which prevents it not being opened by people except tax authorities and registered maintainers. So a fiscal cashier machine ensures tax authorities grasp business data and tax documents accurately.

What benefits can be brought by the widespread use of fiscal cash registers?

Better tax compliance.

The fiscal cash registers record every transaction as well as generate and save sales data automatically. What’ more, no one is able to tamper with the business data. Grasping accurate business data is a great help to government tax revenues. It is more difficult for businesses to cheat on their taxes for their business data will be sent to tax authorities, remaining unchanged. Tax authorities can trace every transaction, making sure businesses pay enough taxes in accordance with law. And therefore, the government’s revenue is guaranteed.

Protection of fair competition.

It is a great challenge for businesses to pay taxes conscientiously and honestly. With the development of technology, it is much easier for businesses to change their sales data to evade taxes. If more and more businesses use technology to tamper with data, it will become more unfair to the honest businesses. In the case of earning benefits, businesses that evade taxes spend less and earn more than businesses that pay taxes honestly. As time passes, less businesses will pay the taxes honestly. Widespread use of fiscal cash registers can efficiently avoid tax cheating, improving the competitive environment. When it gets harder and harder to evade taxes, businesses will pay more attention to improving the quality of goods and services to earn more benefits.

Greater efficiency of the government

Since the fiscal cash registers record every transaction, the business data that tax authorities need are available. Without fiscal cash registers, tax authorities have to conduct field audits in order to determine the reliability of data, which requires much time, money and human efforts. However, the common use of fiscal cash registers can help solve this problem. The tax storage inside providing absolutely reliable information, saving time for distinguishing the business data. What’s more, it ensures data security and the government can be free from the burdens of recording, saving, and reporting, improving the efficiency of tax authorities.

Consumer protection

Recording and saving transaction data not only helps the government improve efficiency, but also protects consumers. If consumers lose their trading certificates, businesses have excuses for not offering after-sales services or returns. If every transaction is recorded, despite losing receipts or other trading certificates, consumers’ rights and interests can be protected. It guarantees consumers to return the goods when they are not satisfactory with their purchases. Accurate recording protects the consumers and creates a good environment for consumption.

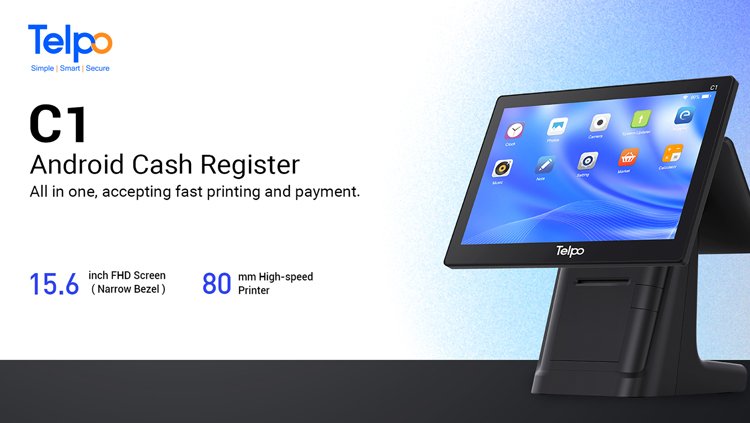

Smart cash registers launched by Telpo support the built-in tax control module. If you need a fiscal cash register, Telpo C1 and TPS680 can satisfy your needs.

Multiple application scenarios

Smart cash registers can be applied in lots of scenarios, such as supermarkets, convenience stores, retail shops and so on. Modern and fashionable design of cash registers upgrades the decoration of the stores.

Increasing chances of attracting customers.

The dual-screen cash registers are good for interaction between customers and clerks. In addition to transaction information and orders, advertisements and promotional activities can be shown on the customer display.

TPS680 Fiscal cash register

Supporting face payment.

With a 3D facial recognition camera, smart cash registers launched by Telpo support financial-level face recognition payment. It is much more convenient for customers to consume and pay.

Founded in 1999, Telpo is a world-leading smart terminal and solution provider. With the mission to create a colorful future, Telpo develops a full suite of comprehensive products and solutions for all walks of life. Telpo products cover the smart payment, smart retail, smart security, smart transportation, and V-loT field. Telpo is devoted to being your trusted partner.