Quick Insights:

Biometric handheld payment terminals are redefining the global fintech landscape by integrating physiological markers—such as fingerprints, facial recognition, and iris scans—directly into the point-of-sale (POS) experience. According to industry security standards (PCI-PTS), biometric authentication reduces fraud risks by eliminating reliance on easily stolen PINs or passwords, providing a “unique-to-user” security layer that ensures secure and convenient payments for retail, catering, and beyond.

Why Payment Security Needs a New Standard

The evolution of secure and convenient payments.

As digital payments accelerate worldwide, security and user experience have become decisive factors for merchants, banks, and solution providers. Traditional PIN and password-based authentication is increasingly vulnerable to fraud, identity theft, and data breaches. At the same time, consumers expect fast, frictionless, and contactless experiences.

Against this backdrop, biometric payment technologies are emerging as a powerful upgrade to the portable card payment terminal, combining strong identity authentication with seamless usability. Backed by rapid market growth and regulatory support, biometric-enabled terminals are no longer experimental—they are shaping the future of secure payments.

The Rapid Rise of Biometric Payment Cards and Terminals

Market momentum confirms biometrics as a mainstream payment technology.

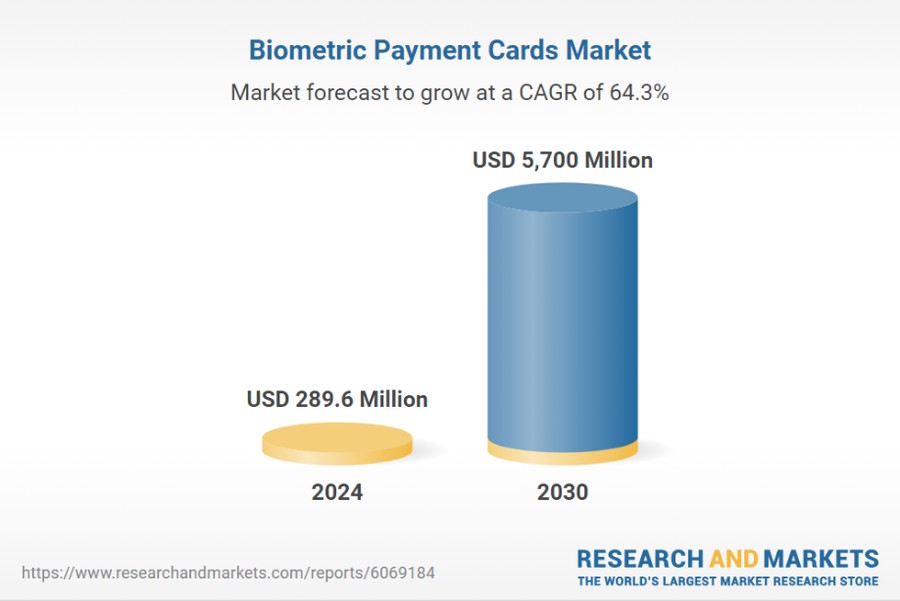

According to a recent industry report, the global biometric payment cards market was valued at US$289.6 million in 2024 and is projected to reach US$5.7 billion by 2030, growing at an impressive CAGR of 64.3%. This surge reflects rising demand for stronger payment security and fraud prevention across both developed and emerging economies.

While biometric payment cards are gaining attention, their real-world impact is maximized when paired with secure, flexible eftpos contactless terminals and wireless card terminal infrastructure that merchants already rely on.

How Biometric Wireless Card Terminals Enhance Payment Security

Biometrics tie transactions to a real person, not just a card or device.

1. Eliminating Weak Authentication Methods Enhanced Security and Fraud Prevention

Biometric payment terminals replace or supplement PINs and signatures with unique biological identifiers such as fingerprints, facial features, or palm veins. Unlike passwords, biometrics cannot be easily forgotten, shared, or stolen.

2. Strong Defense Against Fraud

When integrated into an EMV payment terminal, biometric authentication ensures that even if a card or device is lost, unauthorized users cannot complete transactions. This significantly reduces card-present fraud and identity misuse.

3. Compliance with Financial Security Standards

Modern biometric-enabled terminals are designed to meet stringent global standards such as PCI PTS, EMV, and major card scheme certifications—making them suitable for regulated financial environments.

Better User Experience with Biometrics NFC Card Machine

Security should never come at the cost of speed or simplicity.

1. Faster, Frictionless Transactions

Biometric verification is often faster than entering a PIN, especially in high-traffic retail or F&B environments. Combined with NFC card machine capabilities, biometric terminals enable truly seamless tap-and-authenticate experiences.

2. Ideal for Contactless and Mobile Payments

As contactless payments become the norm, biometric authentication adds a trust layer without disrupting the user flow—perfect for handheld payment terminal and mobile merchant scenarios.

3. Inclusive and User-Friendly

Biometrics reduce reliance on memorized credentials, making payments more accessible for elderly users or customers in regions with low digital literacy.

All in One Payment Terminals in Real-World Applications

From retail to banking, biometrics unlock new use cases.

1. Retail & F&B

In busy retail stores and restaurants, an all-in-one payment terminal with biometric support speeds up checkout while protecting both merchants and customers from fraud.

2. Banking & KYC Projects

Biometric payment terminals play a critical role in Know Your Customer (KYC) initiatives, enabling secure customer onboarding, identity verification, and account access—especially in branch-light or mobile banking models.

3. Emerging Markets & Financial Inclusion

In cashless expansion projects, biometric authentication builds trust in digital payments and supports secure access for unbanked and underbanked populations.

Why the Telpo P9 EMV Payment Terminal Is Built for Secure Biometric Payments

A high-performance portable card payment terminal designed for modern security needs.

The Telpo P9 is a next-generation portable card machine that combines performance, flexibility, and bank-grade security:

-

High Performance: Latest Android OS with an octa-core processor ensures smooth operation for payment and value-added applications.

-

Multiple Payment Options: Smart card, magnetic card, NFC (contactless cards & mobile wallets), QR Code payments, optional fingerprint scanner for biometric payment and KYC use cases

-

Certified Security: PCI PTS V6.x, EMV, PayWave, PayPass, Amex, UnionPay, Discover, Pure, Rupay, and TQM certifications safeguard every transaction.

-

Versatile Use Cases: Ideal for retail, F&B, mobile merchants, and banking KYC deployments.

With its biometric-ready design, Telpo P9 transforms the traditional contactless payment machine into a future-proof security platform.

Telpo Smart Portable Payment Solutions: Security-First by Design

A complete ecosystem for biometric and contactless payments.

Telpo delivers a comprehensive smart payment solution tailored for global payment projects:

-

End-to-End Security: Sensitive data protection, Remote Key Injection (RKI), centralized security management, and PCI PTS-certified terminals.

-

Flexible Terminal Portfolio: Various wireless card terminal options with secondary screens, PDA form factors, built-in printers, and biometric modules.

-

Multi-Payment & Biometric Support: Contactless cards, bank cards, QR codes, e-wallets, and customizable biometric authentication including fingerprint, face, and palm recognition.

These card payment solution capabilities allow acquirers, PSPs, and system integrators to deploy secure, scalable biometric payment infrastructures across diverse markets.

The Future of Secure Payments Is Biometric

Biometric payment terminals are redefining how security, convenience, and trust coexist in the digital payment ecosystem. As fraud risks rise and cashless economies expand, integrating biometrics into a portable card payment terminal is no longer optional—it is a strategic advantage.

Whether you are upgrading retail checkout, launching a mobile banking project, or enhancing KYC compliance, Telpo’s biometric-ready terminals and payment solutions provide the performance and protection needed to stay ahead. Explore the Telpo P9 and discover how secure biometric payments can elevate your business today.