Standalone credit card machines

These are the original type of card swipe machines. A phone line or an Internet connection is required for the standalone credit card machines to send data for processing and authorization, so this kind of card machine needs to be installed in a fixed place. Most standalone credit card machines are equipped with a chip card or magnetic stripe reader, a keypad, display screen, PIN pad, and printer.

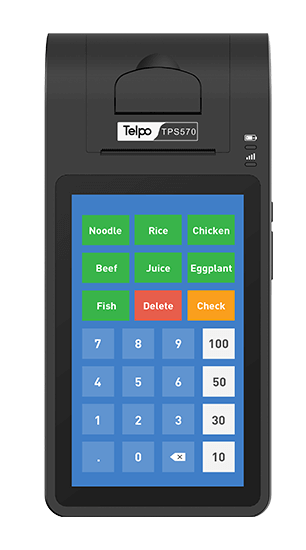

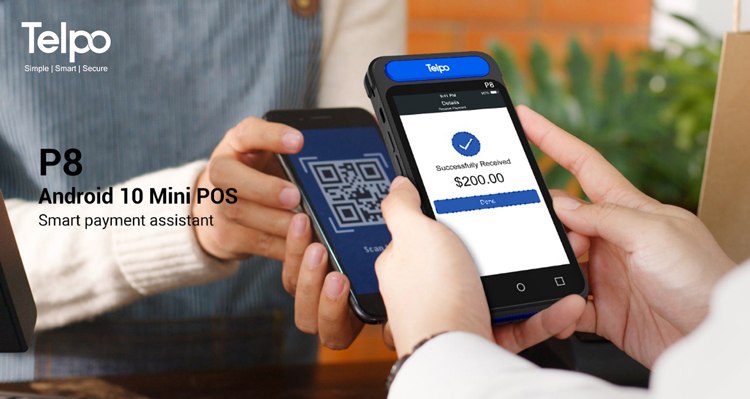

Handheld credit card machines

The basic functions that handheld credit card machines obey are almost the same as that of standalone credit card machines. The main difference is that handheld credit card machines can process transactions via a Wi-Fi or cellular data connection, without a phone line or an Internet connection needed.

Virtual credit card terminals

Virtual credit card terminals require no additional hardware, which let you accept credit cards from any device with an Internet connection. With a virtual terminal, you are able to enter a

credit card manually even if without a card not present.

When to use a standalone credit card machine?

Almost any payment method can be accepted by standalone credit card machines. By offering payment choices from credit or debit card payments to contactless payments, standalone credit card machines satisfy all your needs toward payment options. The only fly in the ointment is that standalone machines are not portable. If you running a store located at a fixed place, don’t hesitate to choose this kind of card swipe machine.

More freedom is given by a handheld credit card machine compared with a standalone credit card machine. There is no need for you to process sales securely by plugging into the ethernet port. Handheld credit card machines are most suitable to be used by mobile restaurants, delivery workers and other merchants who have to be constantly on the go.

When to use a virtual credit card terminal?

If you are with a computer or other Internet-connected device at hand, you can set up a virtual credit card terminal. However, compared to the above two credit card machines, the functions of virtual credit card terminals are not complete enough. Thanks to the low price, it is a good idea for the startups that don’t have adequate funding and have no strong need for a complete POS system or physical POS machines to purchase a virtual credit card terminal.

A handheld credit card machine is the ideal choice for most merchants. It gives more alternatives than traditional credit card machines and has more complete functions than virtual credit card terminals. Even if you suddenly pivot to mobile services from fixed stores, handheld credit card machines also help.

TPS900 is a powerful and multi-functional handheld credit card machine. It offers multiple payment options and enables biometric identification.

High-security certification standards. TPS900 has won a variety of international certifications including PCI, EMV, Ru Pay, CE, FC, etc.

Multi-payment choices. TPS900 offers multiple payment options, including credit card chip card, magnetic stripe card, NFC and QR code payments.

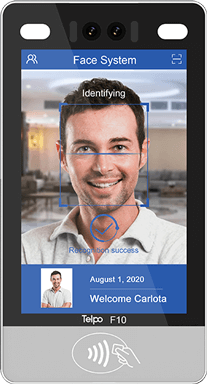

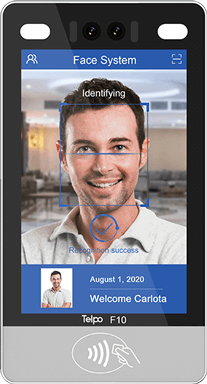

Biometric identification. TPS900 is more than an EFT POS. Secure payment can be easily done guaranteed by fingerprint, iris and face recognition technology.

Tag: handheld credit card machine, credit card machine

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)