In recent years, mobile payment has experienced a significant transformation, revolutionizing the way we conduct transactions. With the rise of smartphones and the increasing popularity of digital wallets, NFC payment and QR code payment have emerged as two dominant methods in the mobile payment landscape. As we enter 2024, the question arises: which payment method will reign supreme in the coming year?

NFC Payment: The Power of Contactless Technology

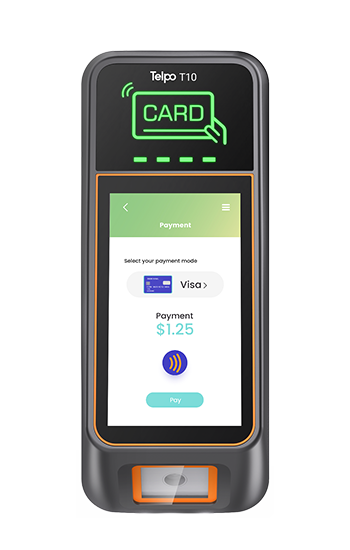

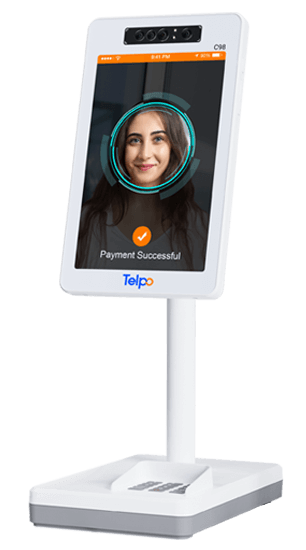

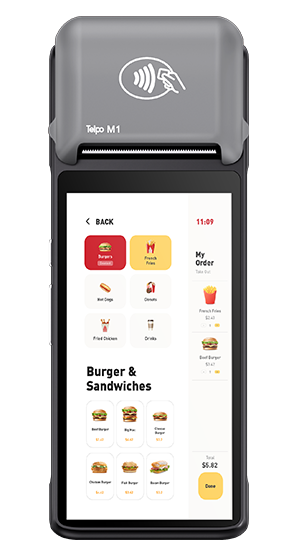

NFC (Near Field Communication) payment allows users to make transactions by simply tapping their smartphones or contactless cards on NFC-enabled payment terminals. This technology offers a seamless and convenient payment experience, as it eliminates the need for physical contact or manual input of payment details. With NFC payment, transactions can be completed in a matter of seconds, making it ideal for quick and efficient payments in various scenarios.

One of the key advantages of NFC payment is its security. NFC transactions utilize encryption and tokenization techniques to protect sensitive payment information, reducing the risk of data breaches.

Additionally, the requirement for physical proximity between the device and the payment terminal adds an extra layer of security, making NFC payment a reliable and secure option.

Furthermore, NFC payment has gained widespread acceptance, with many merchants and businesses adopting NFC-enabled payment terminals.

This wide acceptance has contributed to the growing popularity of NFC payment, making it a convenient and accessible payment method for users worldwide.

QR Code Payment: The Simplicity of Scanning

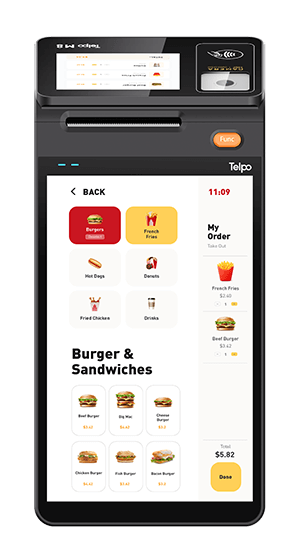

QR code payment, on the other hand, relies on scanning QR codes displayed on payment terminals or presented by merchants. Users can initiate payments by simply scanning the QR code using their smartphones' camera or a dedicated QR code scanning app. QR code payment offers a straightforward and user-friendly experience, as it requires minimal setup and can be easily adopted by merchants of all sizes.

One of the significant advantages of QR code payment is its compatibility with a wide range of devices. Unlike NFC payment, which requires NFC-enabled devices and payment terminals, QR code payment can be used with any smartphone equipped with a camera. This compatibility makes QR code payment accessible to a broader user base, including those with older or non-NFC-enabled devices.

Moreover, QR code payment is cost-effective for merchants. Implementing QR code payment solutions typically involves minimal investment, as it does not require specialized hardware or infrastructure. This affordability has made QR code payment an attractive option for small businesses and emerging markets, where cost considerations play a crucial role in payment adoption.

The Battle for Supremacy: Pay with NFC vs. QR Code

While both NFC payment and QR code payment have their strengths, they also face certain limitations that may impact their widespread adoption in 2024.

For NFC payment, one of the challenges is the requirement for NFC-enabled devices and payment terminals. Although the number of NFC-enabled smartphones is increasing, there are still users with older devices that lack NFC capabilities. Additionally, some merchants may hesitate to invest in NFC-enabled payment terminals due to cost considerations or compatibility issues. These factors could limit the reach of NFC payment, particularly in regions where NFC infrastructure is not yet fully developed.

On the other hand, QR code payment's main limitation lies in its reliance on visual scanning. While scanning QR codes is relatively simple, it still requires users to position their smartphones correctly and ensure a clear and readable code. In situations where lighting conditions are poor or the QR code is damaged or distorted, scanning may become challenging or even impossible. This limitation could hinder the widespread adoption of QR code payment, especially in environments where quick and reliable scanning is essential.

Looking Ahead: The Future of Mobile Payments

As we look towards 2024, it is difficult to predict with certainty which payment method will emerge as the best. However, considering the advantages and limitations of NFC payment and QR code payment, it is evident that both methods have their merits and are likely to coexist in the mobile payment landscape.

In the near term, NFC payment is expected to continue its growth, driven by the improving popularity of SoftPOS and increasing adoption of NFC-enabled devices and payment terminals. The convenience, speed, and security offered by NFC payment including SoftPOS make it an attractive choice for users and merchants alike. As NFC infrastructure becomes more prevalent globally, NFC payment has the potential to become the dominant payment method in various sectors, including retail, transportation, and hospitality.

On the other hand, QR code payment's simplicity and compatibility make it a versatile option that can be easily adopted by businesses of all sizes. The low cost of implementation and the broad user base it can cater to make QR code payment an appealing choice, particularly in emerging markets and industries where cost considerations are paramount.

Conclusion

In conclusion, while NFC payment and QR code payment each have their strengths and limitations, it is likely that they will coexist as the best payment methods in 2024. The widespread adoption of NFC payment will continue to grow, driven by the increasing availability of NFC-enabled devices and payment terminals. At the same time, QR code payment will maintain its popularity, especially in markets where cost-effectiveness and compatibility are crucial. As the mobile payment landscape evolves, it is essential for users, merchants, and industry stakeholders to embrace both NFC payment and QR code payment, ensuring a diverse and inclusive payment ecosystem that caters to the needs of all.

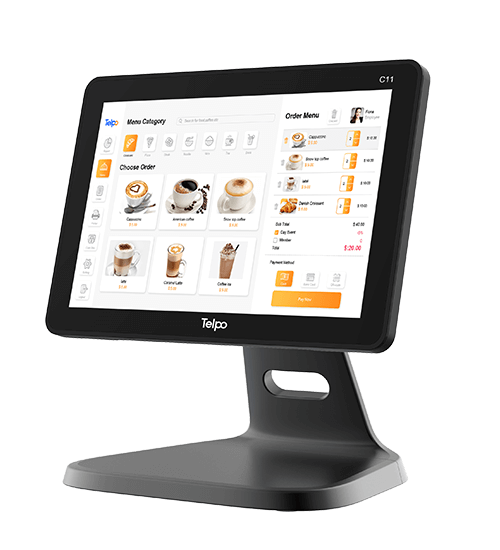

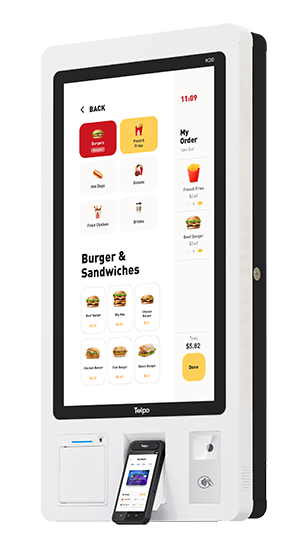

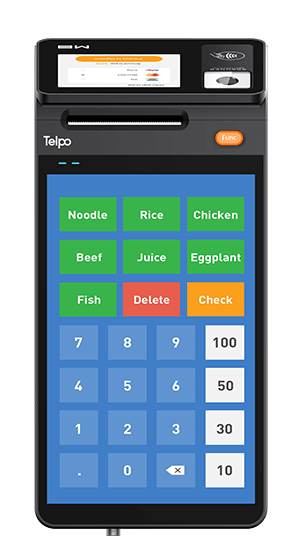

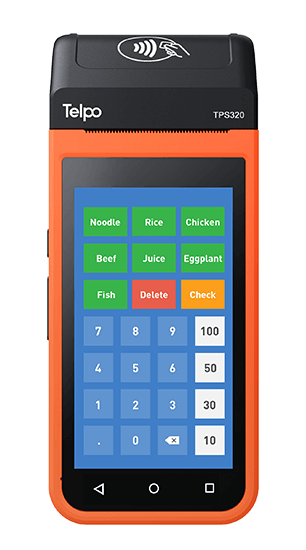

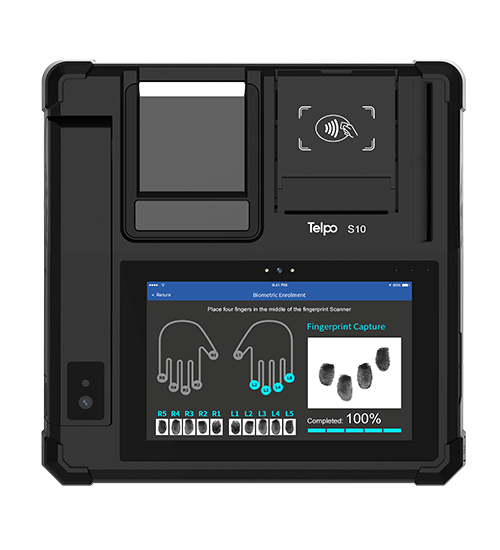

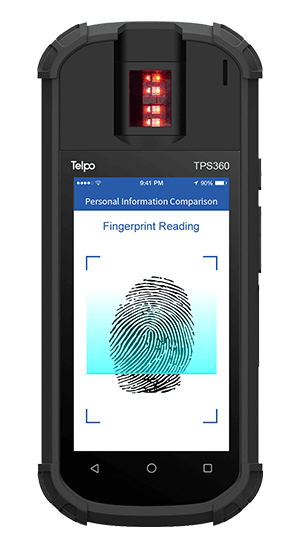

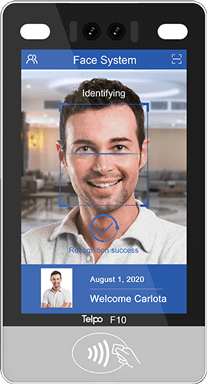

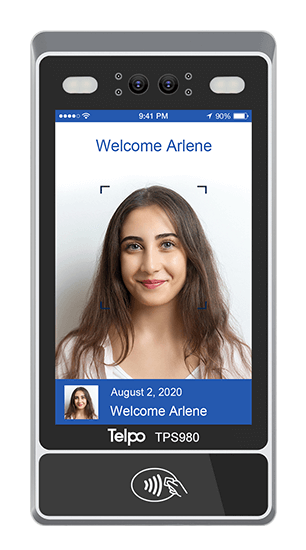

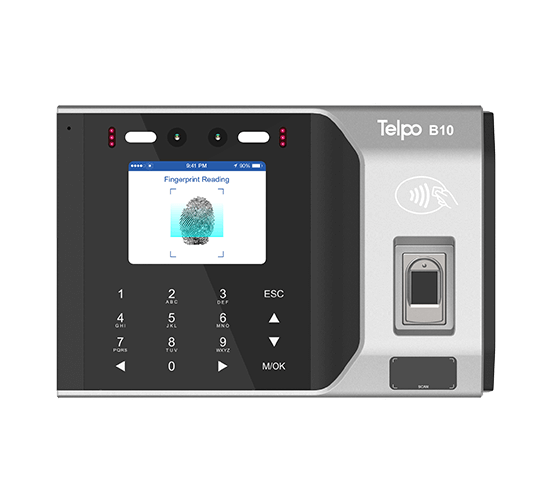

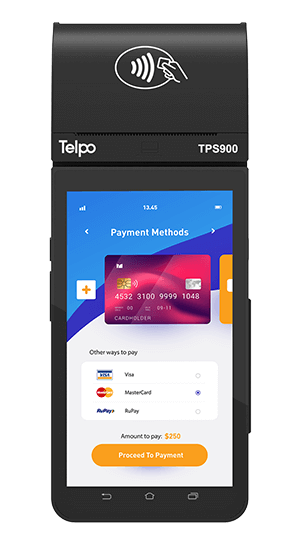

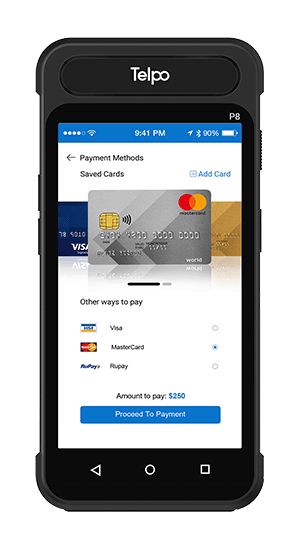

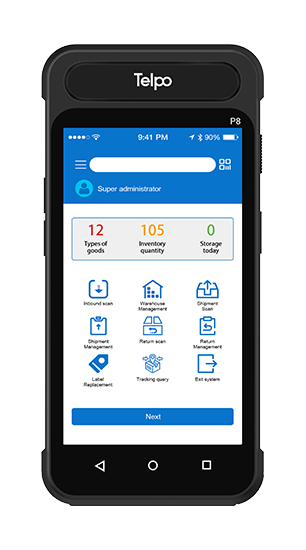

Telpo has introduced a diverse range of NFC-compatible POS terminals to cater to the increasing demand for SoftPOS and NFC payments. Whether you require handheld or countertop terminals, or small-size POS to normal Android desktop POS, Telpo can fully accommodate your needs. Feel free to reach out to us for further details.

Tag: NFC payment, QR code payment, SoftPOS, QR code reader, payment with QR code, NFC POS terminal, contactless payments, mobile payments, digital wallets, cashless payments, payment trends,

future of payments, NFC technology, QR code technology

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)