Recently Kyrgyz State Tax Administration reported that the use of cash registers without fiscal module function have expired from February 28, 2023. Indeed, Kyrgyzstan is not the first country to mandate the use of tax-controlled cash registers. Before this, many countries have already used fiscal cash registers to improve the efficiency of tax control.

Which countries have mandated the use of fiscal cash registers?

With the demand for higher tax-control efficiency, a growing number of countries implement tax-controlled cash registers to ensure tax compliance of enterprises and made great achievements.

· Brazil

Brazil was one of the first countries to introduce tax-controlled cash registers, back in 2008. Electronic Tax Invoice System is Brazil’s main fiscal software, which allows businesses to issue electronic invoices for tax purposes and the government to receive the invoices directly.

· France

The electronic fiscal device is named SCES (Système de Caisse enregistreuse Sécurisée) in France. The certified cash registers are connected to the Internet so that sales data generated by businesses can be transmitted to tax authorities, and thus efficient tax supervision can be achieved.

· Mexico

Mexico has implemented SIF (Sistema de Registro Fiscal) since 2011. Businesses can directly transmit the data to the government by using certified tax-controlled cash registers.

In addition to the countries listed above, fiscal cash registers have helped many other countries improve tax control accuracy and efficiency, such as Russia, Italy, Hungary, Poland, Italy, Spain, etc. Though names of tax-controlled cash registers vary by country, it has become an established fact that more countries turn their eyes to fiscal cash registers.

Why did introducing fiscal cash registers become a trend?

More benefits of electronic fiscal devices are being seen and an increasing number of countries have turned their eyes to them.

For the government, tax-controlled cash registers are a useful tool to supervise tax payments of enterprises in high efficiency and create an economic environment for healthy competition.

· Protect tax revenue

Taxation is one of the government’s main sources of revenue. Mandatory use of fiscal cash registers helps the government count the tax amount accurately, ensure tax compliance of enterprises and protect the government from losing revenue. With the right amount of tax revenue collected, the government can fund more to public services and infrastructure.

· Transparent tax supervision

The certified cash registers can directly transmit the sales data to the tax authorities so that the government can grasp the businesses’ transactions and income comprehensively and efficiently. By keeping a transparent track of enterprises, tax authorities can crack down on tax evasion effectively.

· Create a level playing field

Since electronic fiscal devices make enterprises without exception comply with the tax obligation, the situation that some enterprises obtain more profits from tax evasion can be efficiently eliminated. By guaranteeing taxation fairness, businesses will put more attention to technology innovation and product improvement to win the competition. This promotes healthy competition and keeps the economy improving.

New Telpo M8 Smart Fiscal Device

For enterprises, tax-controlled cash registers support all the functions that general POS terminals have. Besides, compared to common cash registers, electronic fiscal devices have higher security and help conduct more efficient tax management.

· Tax regulation compliance

Designed to comply with tax regulations, fiscal cash registers ensure the accurate reporting and recording of enterprises’ sales data. Though tax laws are becoming more complex, intelligent electronic fiscal devices can help businesses with tax compliance and protect enterprises from damaging their reputation by inadvertently evading taxes.

· Higher security

To protect against fraudulent activities, most fiscal cash registers have a higher security standard for obtaining features including data encryption, user authentication, etc. By protecting sensitive sales data, the fiscal safety of businesses can be ensured.

· Streamline operation

POS terminals are recognized as useful tools for improving efficiency and streamlining operations. As one of the POS terminal Family, electronic fiscal devices absolutely achieve higher efficiency without any doubt. When sales input transaction items into the cash register, the machine can automatically proceed with the processes such as amount payable counting, tax calculation, receipt printing, data storage and so on. By applying fiscal devices, cashier efficiency can be greatly improved.

· Better fiscal management

Thanks to the function of data storage, business operators can get an overall understanding of their businesses. By reporting tax fees, operators can clearly know how much they pay in taxes. At the same time, the cash register can generate a report of product sales and inventory, and thus operators conduct more efficient and effective management.

Applying fiscal cash registers has been a global trend and it’s important for businesses to select a reliable fiscal machine provider. Telpo is an electronic fiscal device provider with 24-year experience and can offer a wide variety of fiscal POS machines.

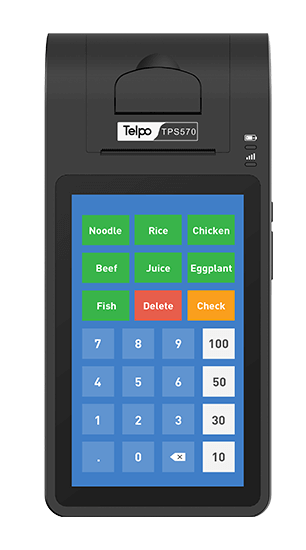

Desktop fiscal cash register, Telpo C1

Telpo C1 is a dual-screen fiscal POS running on Android 9 OS and supports multilingual printing and multiple payment options. It can improve efficiency for business operations and elevate the experience of customers.

Features:

🔸200mm/s multilingual printing: 80mm paper roll, enables multilingual printing including receipt, QR code, image, etc.

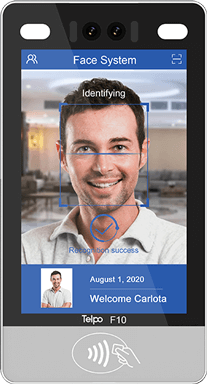

🔸Ample payment options: contactless cards, chip cards, face recognition, etc.

🔸4 screen sizes optional

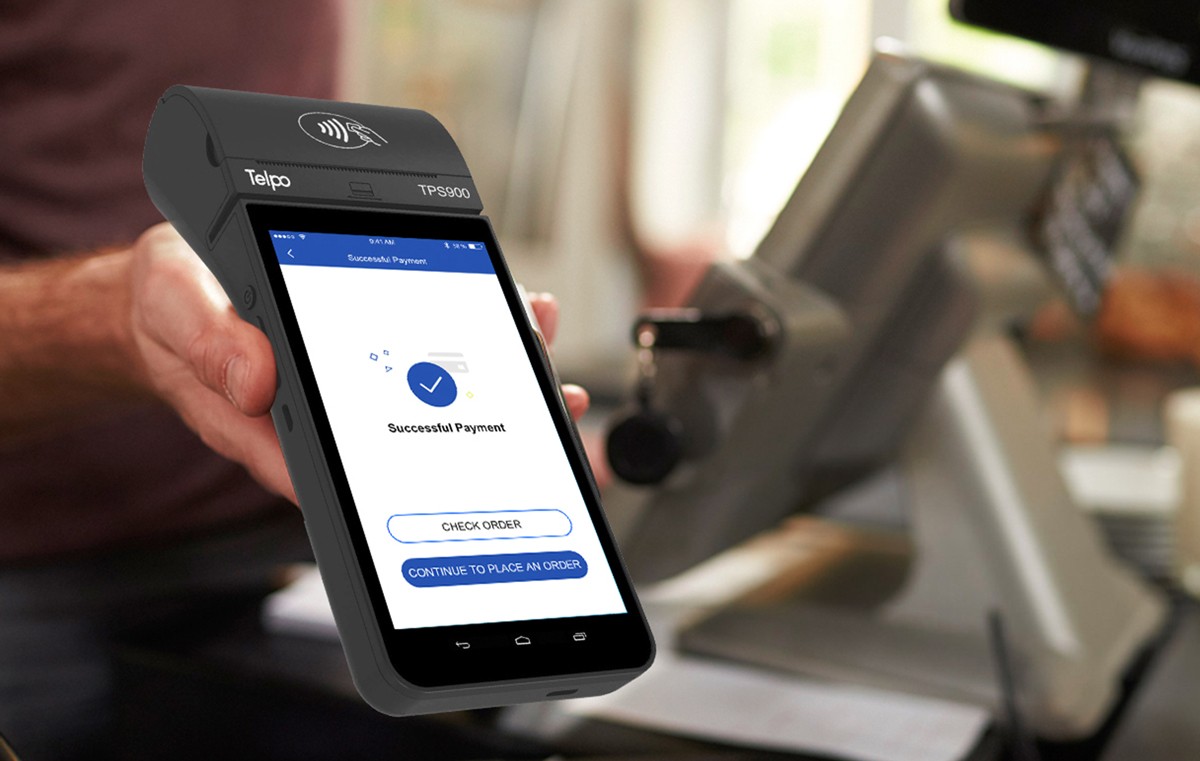

Smart electronic fiscal device, TPS900

TPS900 is a mobile EFT POS running on Android 10 OS and obtained various certifications including PCI 6.X, EMV, PayPass, MIR, RuPay, etc. It is a secure enough payment-acceptance device and enhances efficiency for both businesses and customers.

Features:

🔸Ample payment options: MSR, credit card chip card, NFC, e-wallet, QR code, LFD fingerprint, face recognition, etc.

🔸Multilingual printing: 40mm print head, 80mm/s printing speed

🔸Full connectivity: Bluetooth, WiFi, 4G, GPS

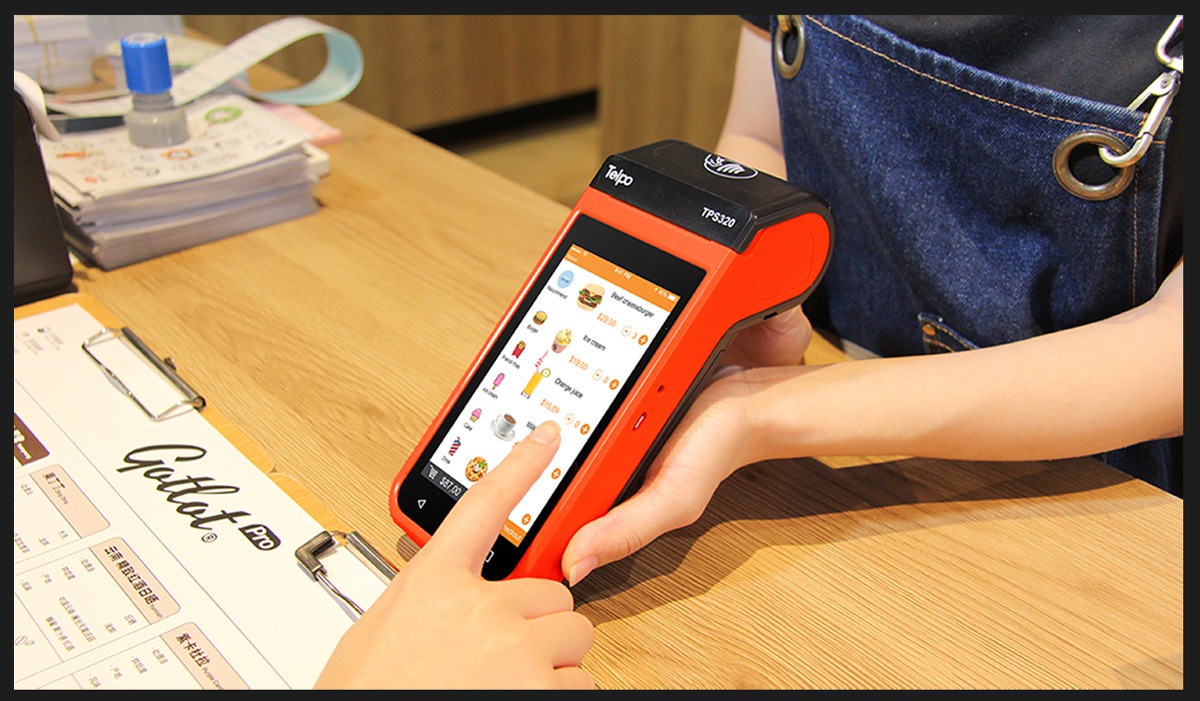

Mobile fiscal POS, TPS320

TPS320 is a mobile POS terminal equipped with a Quad-core CPU and 5000mAH battery. It is easy to carry and can accept payments both indoors and outdoors.

Features:

🔸Accept all smart payments: QR code, e-wallet, NFC, IC card, etc.

🔸Multilingual printing: 40mm paper roll, support printing of fiscal data, barcode, website, menu, etc.

🔸7.4V/5000mAH battery: 2-day standby time and 15.8-hour working time available

It is worth mentioning that all fiscal machines launched by Telpo support the function of fiscal registration and can be compatible with tax-controlled modules and legal standards of different countries. What’s more, Telpo has rich experience in providing fiscal devices for customers worldwide. Up to now, Telpo’s fiscal machines have served customers from Azerbaijan, Kenya, India, Sri Lanka, Russia, etc.

Welcome to contact us for more details! Telpo has the confidence to make you satisfied!

Tag: fiscal cash register, tax-controlled cash register, electronic fiscal device, fiscal POS

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)