How Does Electronic Tax Register Facilitate Tax Administration?

Drivenby the goal of increasing efficiency and effectiveness in tax administration,ensuring sales transaction transparency, tax collection legality, and fightingagainst tax evasion, countries encourage tax invoice management systems and ElectronicTax Registers to simplify users’ interaction and achieve accurate taxinvoice validation.

What are the tax invoicemanagement systems and Electronic Tax Registers?

Thetax invoice management system is similar to the information technologyintegration system that integrates trader systems with government online revenuecollection registration system. As it can validate and authenticate the taxinvoices at trader sides before transferring the generated invoice, it isconducive to simplifying the tax processes, shortening the queuing time, verifyingtax registration status, and increasing revenue collection.

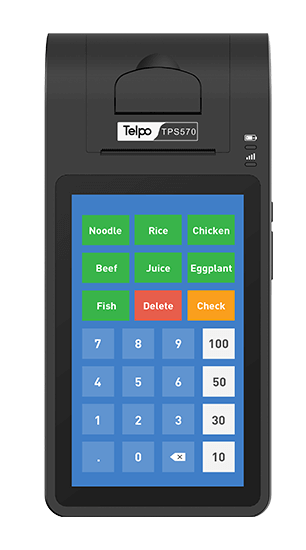

Andthe Electronic Tax Register is akin to a fiscal POS that is designed to recordsales and provide ECR receipts to customers. The Electronic Tax Register with a control unit can perform the functions of tax invoices validation,encryption, signing, transmission, and storage. It is good to monitor real-time transactions and ensure data transparency.

How does an Electronic TaxRegister facilitate tax administration?

To begin with, we should understand what the Electronic Tax Register work. Generallyspeaking, the Electronic Tax Register typically processes commodities in four parts. That is, scan thecommodity barcode, verify the product information with the database, showbilling amount, complete transaction, and print the receipt to the customer.

Asthe data will be transmitted once the transaction is made through the ETRmachine, meaning that the tax revenue authority can constantly monitor thetaxpayer to ensure tax transparency. The GPRS can track the location of eachETR device and transmit data to a central location. It ensures revenueauthority has access to all payment records made before filing tax returns, solvesthe problem of the business failing to pay the tax due to the stolen of thedevice, and eliminates the losing revenue condition. And the high-quality ElectronicTax Register can work for a few years and you need not purchase a new onetime by time.

Oncea transaction is made, data will be transmitted to the central revenue serveranywhere and anytime. All data will be calculated and stored for accountchecking when actual tax returns are applied each time at the end of the month.It will help governments save millions in the cost of operation.

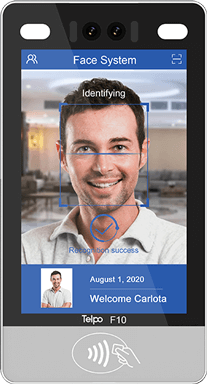

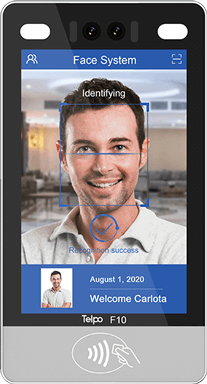

Moreover, the ETR cash register has great security as there is asecurity mechanism and data protection inside it. Given that, the business canensure transparent salestransactions while giving access to internal monitors to track tax recordsthrough system-generated receipts and make reconciliation and monitoring oftaxes easier for the National Revenue Authority.

Last not but least, the ETR cash register also allows tax authority timelyand automatically obtain more VAT information, increase fiscal control andprevent tax evasion and promote the digitalization process. Andcustomers can use e-invoicing as an effective purchase credential and make taxreductions.

How should you choose an Electronic Tax Register?

As we mentionedabove, a high-quality Electronic Tax Register can help yousave costs and improve business operations. Before you decide to purchase one,here are some factors you should take into consideration. As differentcountries might have various policy demands, the listed factors are just for reference.

Configuration: If you are installingan Electronic Tax Register for thefirst time, make sure the one you pick has a large memory capacity and controlunit. The excellent configuration and easy development operating system havestronger compatibility and can run more complex record-keeping and storing moredata.

Payment mode: Peoplehave various payment habits (Cash, Debit Card, Credit Card, Pre-paid Card,Mobile Money, EFT, RTGS, Credit Note) and tax collection demands are quitedifferent across payment options. That means you need to consider which paymentmethods you plan to support.

Communication: Stable network communicationis the key to make sure data transmission. The more communication ways can the Electronic TaxRegister support, the more communication choices can be enjoyed. It is good tosolve the problem of weak signals.

Telpo Electronic Tax Register solution

As a high-techcompany with social responsibility, Telpo rolls out a host of Electronic Tax Register solutions in aneffort to strengthen tax collection and facilitate tax administration.

The first solution mainly protects thedatastore from access physically. We can provide the hardware (Electronic Tax Register,tax collection module port, storage space) and software (system tamper-proofsupport). The ETC device will be placed inside the fixed warehouse body, whichis sealed with lead seal screws and epoxy resin.

The secondsolution is based on password security of the reservation recorded data. Systemtamper-proof mechanism, signature protection, and application certificate canbe provided. It will generally require an anti-dismantle machine system,software signature mechanism + fiscal module + lead seal screw. Data encryptionand security mechanism in line with the law demands are also supported.Besides, it may relate to some security protection includes anti-burn forphysical or signature protection for software. There are two methods forencryption protection, one is data signature, and another is dataencryption.

The thirdsolution allows the direct transfer of the data of the Electronic Tax Register to the tax authority online. And we canprovide a system remote port. Apart from data transmission and storage, it has agreat challenge on data connectivity. It requires an Electronic Tax Register to transmit all transactions to thefinancial server via the Internet. The server should store and verify the datain real-time and return the electronic confirmation letter to the Electronic Tax Register. Second, itrequires data interchange between the platform and fiscal POS. 4G, WiFi,Ethernet such communication are required.

Product feature:

- 5-inch display, Qualcomm Quad-core CPU, Android 7 version+ 2GB DDR+16 eMMC

- Maximum 4SIM cards, support multi-operator countries.

- 40mm printer supports web printing, label printing,ECS\POS printing

- Multiple payment modes include cash, NFC card, pre-paid card, mobile money, QR pay, etc

- 5000mAH large battery supports long battery life and longtime working

- Full communication include LTE/WCDMA/GPRS/WiFi/Bluetooth

- Encrypted storage, anti-disassembly mechanism, customization services, etc are supported

Nowadays, Telpo Electronic Tax Registers have been used in Russia, Azerbaijan, Venezuela, Kenya,and other countries. We can provide professional and even customized solutions accordingto your demand. If you want to know more details, welcome to contact us.

Tag: Electronic Tax Register, Electronic Tax Register solution, ETRdevice

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)