Saudi Arabia has made it mandatory for the retail sector in the Kingdom to provide electronic payment methods to customers since 25th Aug, Saudi Gazette reported. The Ministry of Commerce will carry out field visits within sphere the scope of authority, and ensure the availability of electronic payment services, even crack down on violations and impose penalties.

Saudi Arabia has forced retailers to provide electronic payment methods to customers since 25th Aug.

Why Saudi Arabia will force the retail sector to provide electronic payment?

The move is in line with the implementation of the National Program to Combat Commercial Cover-up (tasattur), and make further steps to reduce cash circulation, eliminate shadow economy, upgrade the level of electronic services, protect consumers and create a cashless society.

In fact, Sweden, Finland, Singapore, India, and other countries are vigorously promoting electronic payment, ambitious to create a cashless society, and see it as an important means to save social resources. Thus, what exactly the role would Saudi Arabia electronic payment play in promoting social development?

1. Saving social resources, reduce social costs, and reduce environmental damage would be the first role.

A lot of resources will be consumed in printing and circulation of cash, and cause social costs in transportation and transaction. On the contrary, e-payment is conducive to save social resources as it merely relies on electronic devices, bank cards these media for digital information transmission, and transactions.

2. Next, electronics can reduce the spread and infect bacteria.

At the early break of the pandemic, the World Health Organization (WHO) said “it’s possible” for the virus to spread through banknotes, and advised counties to switch to contactless payment. Because cash goes through the countless environments and people in circulation, thus bacteria will be easily attached and spread.

3. Last but not least, it will be safer for consumers to use the e-payment method as it can reduce the risk of steal and theft in Saudi Arabia.

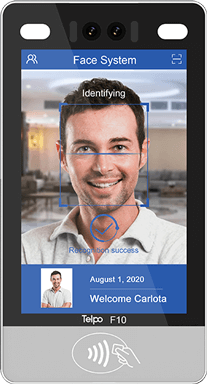

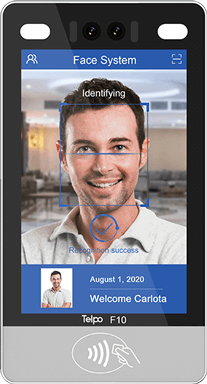

Banknotes, coins and other currencies are prone to lost or stolen while being carried. By contrast, e-payment is more secure as it can count on a password or biometric feature to make verification.

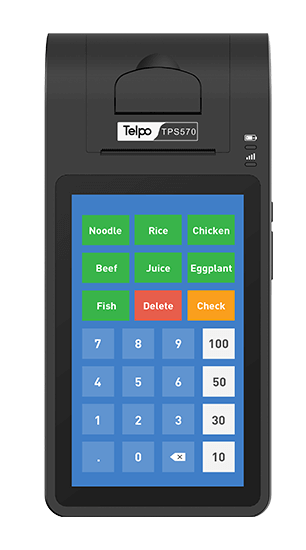

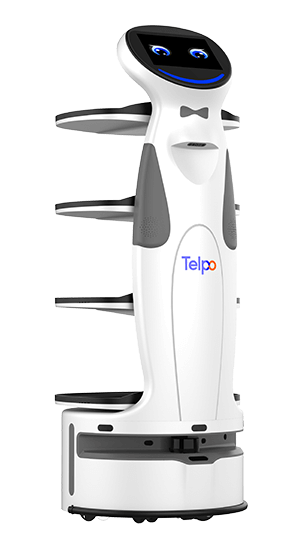

As the first face payment terminal and facial thermometer provider, Telpo is capable of providing face payment devices, as well as a series of electronic payment devices that support QR pay, fingerprint payment, and NFC card payment to all retail sectors.

Meanwhile, Telpo products can also support the tax control function, which is conducive to monitor the retail sector to standardize the transaction process, reduce counterfeit money, strengthen anti-money laundering, and further accelerate the construction of a cashless society.

Tag: Saudi Arabia e-payment, retail payment, electronic payment, cashless society, electronic payment device, face payment device, QR pay

Brief Introduction: Telpo is a professional smart payment partner who focuses on the ODM service 20 years. It mainly provides the EFT-POS, cash registers, biometric devices, facial recognition machines, self-service kiosks, and bus validators. Telpo has served for more than 1000 customers abroad, including government, banks, Telecom operators, police stations, Retail shops, and offices. Telpo adheres to R&D and innovation, aiming to provide more intelligent hardware for global partners.

.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/07/Telpo-C2-80-printer-550.png?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=*2023/09/C2-printer-250.jpg?VGVscG8tQzItUG9pbnQgb2YgU2FsZSBUZXJtaW5hbCA=)